The future is unpredictable and uncertain. And given what an indispensable role money plays in your life, it is important to invest it in the right avenues that fetch good returns and help us reach our immediate/short-term goals. And to do that, you need to learn about the best investment plan for 1 year.

What are Short-term Investment Plans?

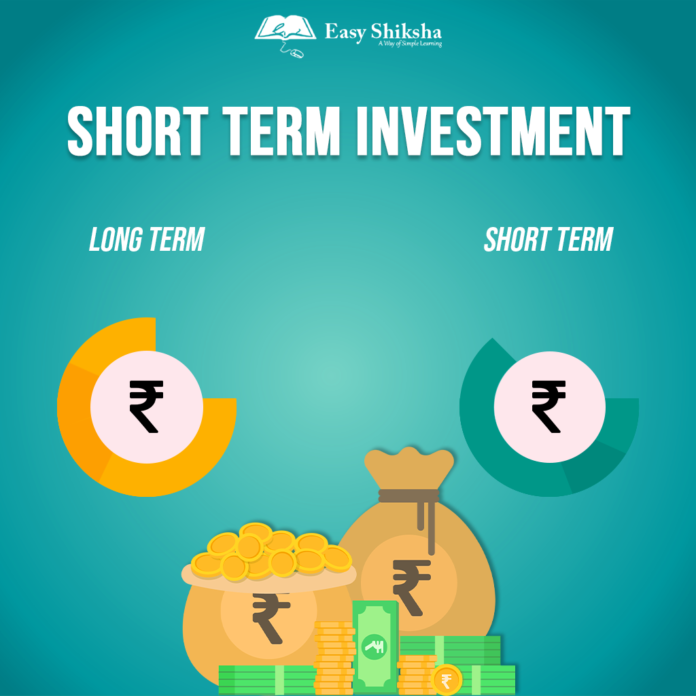

Investment options in India can be divided into two categories – short-term and long-term investment plans. Short-term investments, as the name suggests, are made for shorter tenures, that is, one or two years. They are helpful short-term goals like saving money for a new laptop, an upcoming family vacation or anything that you may need anytime soon. There are several short term investment plans out there that can help you save, and the best investment plan for 1 year would help you make quick returns.

Any investment made for over five years would be considered a long-term investment, meaning that you will not be requiring the funds until the need arises. Instead of opting for long-term investments, you can also choose to reinvest in the best investment plan for 1 year or more.

Best Investment Plan for 1 Year or More

If you are looking for the best investment plan for 1 year or more, we have a few suggestions for you that might be helpful.

Recurring Deposits

Recurring deposits are the most common short term investment option used by people to save their money for short-term goals or needs, securely. Recurring deposits are offered by most banks and allow the investor to earn fixed interest on the amount invested until maturity. You can easily open a recurring deposit (RD) account through net banking services. All you have to do is select the amount you wish to save every month, the tenure, and viola, you are done.

Rate of Return: 4% to 6%annually

Tenure: 6 months to 10 years

Taxability: The interest earned from the RD account is added to your income and is then taxed as per the individual’s tax slab.

Fixed Deposits

When it comes to picking out thebest investment plan for 1 year or more, fixed deposits are one of the most popular options for creating a corpus over a short time. The sum is invested for a predetermined time period—anywhere between 7 days and 10 years—at a fixed rate of return, after which it automatically reaches maturity and becomes available for withdrawal. Although the interest rates are larger than those of savings accounts and RDs, early withdrawal is not an option.

Rate of return: 2.5% to 5.5% annually

Tenure: 7 days to 10 years

Taxability: The interest from the FD account is added to your income and is then taxed as per the individual’s tax slab.

Corporate Deposits

Similar to bank fixed deposits, the only distinction is that corporates gather these deposits for growth and operations. Because there is a greater danger of default, the interest rates are a little higher than those on bank FDs. These corporate FDs offer higher returns in comparison to regular fixed deposits for investors who are willing to take on some risk.

Rate of return: 6% to 8% annually

Tenure: 1 to 3 years

Taxability: The interest earned from these deposits is added to your income and is taxed as per the prevailing income tax slab.

Debt Mutual Funds

These mutual funds invest the money largely in debt securities such as corporate bonds, government bonds, treasury bills, commercial papers, and similar money market items. For those who are risk-averse and seeking greater short-term returns, this is one of the best investment plan for 1 year or more.

Rate of return: 8% to 11% annually

Tenure: 6 months to 3 years

Taxability: If the units are redeemed within three years, short-term mutual funds are computed, and long-term capital gains are assessed if kept for more than three years on your income.

SIP in Equity Mutual Funds

Systematic Investment Plans (SIP) are most effective over the long term, but they can also be used to generate respectable returns over shorter time frames. It is advised to start a SIP in large-cap mutual funds if you are considering an investment period of up to one year because they invest in big businesses that can rise more quickly in the market.

Return on investment: 8% to 15% annually

Tenure: 6 months to 5 years

Taxability: Just like debt mutual funds, equity mutual funds base their returns calculations on both short- and long-term capital gains.

Besides these, an investor meaning to lock-in their money for either short or long period of time, also has other options. These investment options include the stock market, large cap mutual funds, precious metals like gold and silver, etc. By investing your money at the right place, you can ensure financial freedom and create a safety net that will be helpful during emergencies.

Also Read: Emerging Opportunities for Full-Stack Developers in India