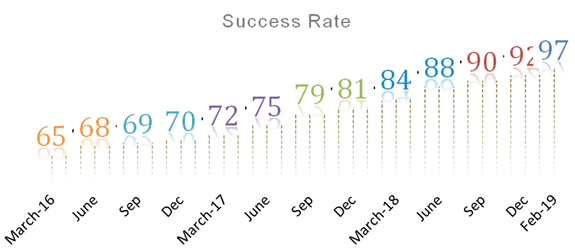

New Delhi, March 11, 2019: MobiKwik, India’s largest fintech company, today announced that MobiKwik Payment Gateway previously called Zaakpay has consistently clocked an industry-best transaction success rate of over 93%. Coupled with intelligent routing and deep integration, MobiKwik’s average transaction success rate for credit and debit cards has been recorded in the range of 90-97% and that for net banking has been in the range of 80-85%.

MobiKwik’s Payment Gateway has recorded an average transaction success rate between 85-95% over the last few months depending on the mode of payment, as against industry average of 65-70% (for online transactions). It is trusted by over 7000 Indian businesses and its systems can handle 3-5X peak on current infrastructure and can quickly scale to handle 10X. It is an extremely developer friendly platform. Also, another key reason why customers choose MobiKwik Payment Gateway is because it not only offers all the payments options like credit card, debit card, net banking, UPI etc, but also has customised user flows for different kind of merchants depending upon their business needs.

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

Speaking on the accomplishment, Mr. Sushant Kashyap, Senior VP and Business Head for Payment Gateway and International Business, MobiKwik said “In today’s internet era, a stable payment platform that provides the best success rate in the industry is paramount to the success of any online business and the end-user experience. In order to achieve the best success rate, we work very closely with our partners and through custom integrations provide best-in-class services which is not only scalable, reliable, but also has the best end user experience. We have been able to innovate and build systems internally which not only monitor and divert transactions to different acquiring banks if they see any downtime, but also through machine learning decide which payment instrument should be routed to which issuing bank and schemes for best success rate basis their past performance. All of this happens on real time basis, thereby making our gateway best-in class in the industry.”

MobiKwik’s Payment Gateway was launched in the year 2011 with a vision to simplify payment systems in India. It has thousands of partners spread across a wide range of industries including grocery, travel, utilities, telecom, health, education, auto, finance and ecommerce. MobiKwik

Payment Gateway is committed to delivering excellent service and has a dedicated NOC (Network Operations Centre) which works 24*7*365 days and ensures 99.999% uptime. The MobiKwik Payment Gateway is the payment platform of choice for large enterprises and start-ups, including Uber, Zomato, IRCTC, Grofers, amongst others.

MobiKwik Payment Gateway offers innovative solutions including subscription and recurring payments for SaaS billing models as well as the option of payments via Text Message or email link. Also, it offers Dynamic Marketplace Solutions for many-to-many payments. Additionally, it provides PCI-DSS compliant Save Cards Solution for online platforms to accept debit/credit cards without the need to do security certifications.

Top Courses in Software Engineering

About MobiKwik:

MobiKwik is India’s largest issuer-independent digital financial services platform, leveraging a sophisticated product and merchant acquisition capabilities. It is the second largest mobile wallet player in India. It has a network of over 3 million direct merchants, 140+ billers and over 107 million users. It has recently ventured into credit with the launch of its instant credit product called ‘Boost’. MobiKwik has also announced its foray into wealth management with 100% acquisition of Clearfunds, one of India’s leading new age wealth management platforms.

Founded in 2009 by Bipin Preet Singh and Upasana Taku, the company has funding from Sequoia Capital, American Express, Tree Line Asia, MediaTek, GMO Payment Gateway, Cisco Investments Net1 and Bajaj Finance. The company has offices across many cities in India including New Delhi, Mumbai, Bangalore, Pune and Kolkata. It aspires to be the largest source of digital transactions in India and has a vision of enabling a billion Indians with one tap access to digital payments, loans, insurance and investments, by 2022.

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowQ. Are EasyShiksha's internships truly free?

Yes, all internships offered by EasyShiksha are completely free of charge.

Q. How can I apply for an internship with EasyShiksha?

You can apply by visiting our website, browsing available internships, and following the application instructions provided.

Q. What types of internships are available through EasyShiksha?

EasyShiksha offers a wide range of internships across technology, business, marketing, healthcare, and more. Opportunities are continuously updated.

Q. Will I receive a certificate upon completing an internship?

Yes, upon successful completion, you will receive a certificate recognizing your participation and achievements.

Q. Are EasyShiksha's internship certificates recognized by universities and employers?

Yes, the certificates are recognized by universities, colleges, and employers worldwide.

Q. Is the download of certificates free or paid?

Access to internships and courses is free, but there is a small fee to download certificates, covering administrative costs.

Q. When can I start the course?

You can choose any course and start immediately without delay.

Q. What are the course and session timings?

These are fully online courses. You can learn at any time and pace. We recommend following a routine, but it depends on your schedule.

Q. What will happen when my course is over?

After completion, you will have lifetime access to the course for future reference.

Q. Can I download the notes and study material?

Yes, you can access and download course materials and have lifetime access for future reference.

Q. What software/tools would be needed for the course?

All necessary software/tools will be shared during the training as needed.

Q. I’m unable to make a payment. What should I do?

Try using a different card or account. If the problem persists, email us at info@easyshiksha.com.

Q. Do I get the certificate in hard copy?

No, only a soft copy is provided, which can be downloaded and printed if required.

Q. The payment got deducted but shows “failed”. What to do?

Technical errors may cause this. The deducted amount will be returned to your account in 7-10 working days.

Q. Payment was successful but dashboard shows ‘Buy Now’?

Sometimes payment reflection is delayed. If it takes longer than 30 minutes, email info@easyshiksha.com with the payment screenshot.

Q. What is the refund policy?

If you face technical issues, you can request a refund. No refunds are issued once the certificate has been generated.

Q. Can I enroll in a single course?

Yes, select the course of interest, fill in the details, make payment, and start learning. You will also earn a certificate.

Q. My questions are not listed above. I need further help.

Contact us at info@easyshiksha.com for further assistance.

ALSO READ: Great-learning-launches-new-programs-in-devops-and-full

Get Course: Learn-Psychology-Online