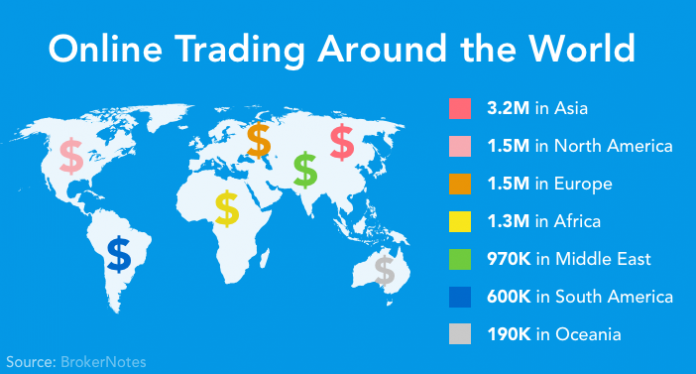

Online trading is the act of trading assets, derivatives, and securities on online trading platforms provided by brokers. One of the main markets is the foreign exchange market (or forex for short), which is also the biggest market in the world based on daily turnover. Although there are many other markets you can trade on as well and the best brokers offer everything from stocks and commodities to cryptocurrencies.

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

Top Courses in Virtual Reality

More Courses With Certification

The online trading industry is tightly regulated and all the most serious brokers have licenses from leading regulatory bodies. In Asia, there are several of these bodies that oversee the market and you should only stick to using licensed brokers, but more about that in a second.

The following guide is an introduction to online trading with a focus on how it’s done in Asia. We’ll provide insight into what to think about before you start trading, how you can develop a good strategy, and where you can find more information about trading to up your game.

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

Top Courses in Virtual Reality

More Courses With Certification

1. Pick a Market With Potential

First and foremost, you have to pick a market that you want to focus on. Even though most online brokers offer several markets, it’s recommended that you stick with one as a beginner. When you’ve mastered that market and understand the basics, you can start incorporating other assets and opportunities.

Many new traders start by trading stocks because it allows them to trade companies that they’re familiar with. Many brokers have stocks from major companies such as Apple, Amazon, and Google listed as well as smaller local stocks.

The forex industry is also a popular one because it’s readily available and provides many opportunities to trade on a daily basis. Currencies also tend to fluctuate quite a bit daily and with the use of leverage you can maximize your exposure for each trade.

In the end, it’s up to you to pick a market you like and think would fit you well. There is no right or wrong here.

2. Find a Licensed Broker

With a market in mind, you have to find a broker that offers that said market with the tools and platforms you need to analyze assets and place trades. As mentioned, it’s important that you only stick with licensed brokers since unlicensed brokers pose too big of a risk.

There are several trustworthy regulatory bodies in the world such as the CySEC (in the EU), the FCA (in the UK), and ASIC (in Australia). But even though they are good and their licenses are some of the most trustworthy in the world, Asian traders should also look for Asian regulation.

In this case, Singapore and the Monetary Authority of Singapore (MAS) is considered one of the best. In the following post, you’ll find a complete list of regulated trading platforms and brokers in Singapore.

3. Study the Basics and Use a Demo Account

Now, you should have a market in mind and a broker you want to test. The next step is to sign up for a trading account so that you can start trading. This is, generally speaking, quite easy, and the broker should provide you with all the information you need to register an account.

Before you start trading, it’s recommended that you spend some time studying the basics of trading so that you actually know what you’re getting yourself into once you get started. Most top brokers provide educational material and that is often the best place to start.

In addition, online brokers have demo accounts which give you the option of trading under real market conditions but with virtual money, thus eliminating all risks. This is, by far, the best way to get more experience and knowledge before you start risking your own money.

4. Begin Developing Strategies

At this point, you’re well on your way to start trading more seriously and after some time playing around with the platforms and tools to get comfortable, you need to up your game a little.

In short, that means learning and developing strategies that will allow you to trade and invest with the purpose of making a profit. As you might imagine, this part is not very easy and it takes a lot of time to learn all the essentials. Therefore, we always recommend that you start small and then work yourself up.

Becoming a good and profitable trader requires time and dedication so don’t beat yourself up if you end up losing when you start. In fact, all traders lose money when they start so that is nothing unique. As long as you have a clear goal and good focus, nothing is stopping you from conquering the world of online trading.

Top Courses in Networking

More Courses With Certification

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowALSO READ:sos-childrens-villages-of-india-and-cii-celebrate-india

Get Course: Understanding-Compliance–Cobit5-Principles