Payroll accounting is a critical function for any business, large or small. Accurately processing employee paychecks, withholding taxes, and maintaining detailed records is essential not only for compliance but also for maintaining positive employee relations and a healthy financial outlook for the company.

EasyShiksha.com, a leading online education platform, understands the importance of precise payroll accounting. Here are the top 7 benefits that accurate payroll accounting can provide for your employees and business:

Online Courses with Certification

Online Courses with Certification

Top Courses in Finance

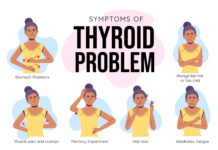

Ensures Legal Compliance

Proper payroll accounting helps ensure that your business is complying with all relevant federal, state, and local tax and labor laws. This includes accurately calculating and withholding income taxes, Social Security and Medicare taxes, and any other required deductions. Failing to comply can result in costly fines and penalties.

Prevents Payroll Errors

Inaccurate payroll can lead to employees being underpaid, overpaid, or not paid at all. This can breed distrust, resentment, and high turnover among your workforce. Precise payroll accounting helps eliminate these types of mistakes, keeping your employees satisfied and your company’s finances in order.

Simplifies Tax Preparation

Detailed payroll records make it much easier to prepare and file accurate tax returns, both for the business and for your employees. This can save time, reduce the risk of audits, and help you avoid penalties for incorrect or late tax filings.

Improves Cash Flow Management

Precise payroll accounting allows you to better predict and plan for your company’s regular labor costs. This helps you manage your cash flow more effectively and avoid shortfalls that could impact day-to-day operations.

Enhances Data Security

When payroll information is managed properly, it helps safeguard sensitive employee and financial data from theft or unauthorized access. This protects both your business and your workers.

Supports Strategic Decision-Making

Robust payroll accounting data provides valuable insights that can inform important business decisions. For example, tracking labor costs as a percentage of revenue can help you optimize staffing levels and identify opportunities for process improvements.

Boosts Employee Satisfaction

Accurate and timely payroll processing demonstrates to your workforce that you value their contributions and are committed to treating them fairly. This can improve morale, productivity, and employee retention.

As a leading online education platform, EasyShiksha.com recognizes that proper payroll accounting is essential for the success of any organization. By leveraging the benefits outlined above, businesses can strengthen their financial management, comply with regulations, and foster a more engaged and loyal employee base.

FAQ: Frequently Asked Questions

Q: How often should a business review its payroll accounting practices?

A: It’s recommended to review your payroll accounting processes at least annually, and more frequently if your business experiences significant growth or changes. This helps ensure continued compliance and identify any areas for improvement.

Q: What are some common payroll accounting mistakes to avoid?

A: Some of the most common payroll errors include miscalculating employee hours, incorrectly withholding taxes, failing to maintain proper documentation, and mixing up employee pay rates or deductions. Implementing strong internal controls and conducting regular audits can help prevent these types of mistakes.

Q: How can technology help improve payroll accounting?

A: Utilizing payroll software, cloud-based accounting systems, and automated time tracking can greatly enhance the accuracy and efficiency of payroll processing. These tools can reduce manual data entry, minimize calculation errors, and provide detailed reporting capabilities.

Also Read: Cryptocurrency and Blockchain: How Cryptography

Get Courses: certificate courses online

Conclusion

Accurate payroll accounting is essential for businesses of all sizes to ensure compliance, improve financial management, and cultivate a positive employee experience. By leveraging the benefits outlined above, organizations can strengthen their overall financial health and position themselves for long-term success. As a leading online education platform, EasyShiksha.com encourages businesses to prioritize precise payroll accounting as a key component of their broader financial strategy.