Adani Green Energy Ltd. Capacity Addition 575 MW

Total operational capacity reached to 2,545 MW#

Revenues up 24% y-o-y to Rs. 2,549crore

EBITDA1 up 4% y-o-y to Rs. 1,782crore

EBITDA2 margins at 89%

Cash profit3 of Rs. 787crore

Ahmedabad, May4, 2020:Adani Green Energy Limited (AGEL), a part of the Adani Group, today announced its financial results for year and quarter ended March 31, 2020.

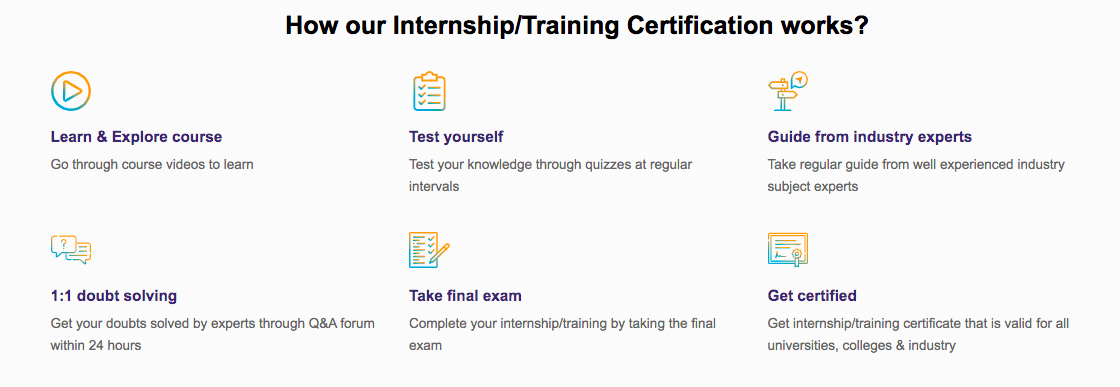

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

| FINANCIAL HIGHLIGHTS

FY20 (Y o Y)

Q4 FY20 (Q o Q)

OPERATIONAL HIGHLIGHTS Total Portfolio · Total contracted portfolio of 5,9906MW, of which 2,545 MW# is operational capacity (includes 150 MW of OEM wind project commissioned during the year).

|

# additionally commissioned 50 MW Solar plant in April 2020.

| Operational performance

Consolidated average realization at Rs. 4.83 ps. Consolidated Financial Performance:In Rs. Crore, except as stated

|

FY 20 Performance ( Y o Y )

Revenue

Total Revenue increased by24% to Rs. 2,549.

Revenue from Power generationup by8% to Rs.2,065 crore due to additional project commissioningand full period operationalisation impact. Number of units sold up by 13% to 4,373Mu’s.

EBITDA and EBITDA Margins

EBITDA1for the year increased by 4% to Rs. 1,782 crore due to increased operating capacity.

EBITDA margin2 during the yearwas 89% compared to 90% last year.EBITDA1 for year got impacted by exceptional cost incurred on the international projects that are sold or called off during the year.

Depreciation and Amortization

Till FY19, The Group was following Written DownValue(WDV) depreciation method.Based on evaluation during the year, AGEL considered to changethe depreciation method from WDV to Straight Line Method (SLM) and has given effect from April 1, 2019.

Due to change in depreciation method, there is reduction in depreciation and amortization.Depreciation for FY20 is Rs.394 crore as against is Rs.1062crore y-o-y and Depreciation for Q4 FY20 is Rs.108 crore as against Rs.293 crore y-o-y.

Finance Cost

Interest and other borrowing cost increase to Rs.1,075 crore as compared to Rs.985 crore y-o-y due to charging of Interest due to projects which were being implementing were commissioned in FY20 and additional debt on account of ramp up of capacity and refinancing.

Exceptional Item

The Group has refinanced its earlier borrowings through issuance of secured senior notes (US$ denominated bonds) and rupee term loans from bank and financial Institutions. On account of such refinancing activities, the Group has incurred one-timeexpenses aggregating to Rs.173 croreduringthe year. These expenses comprise of prepayment charges, unamortized portion of other borrowing cost related to earlier borrowings and cost of premature termination of derivative contracts.

Further, during the quarter the group has incurred one time exceptional loss of Rs. 19 crore because of sale of the Midland project in USA.

Profit/Loss before exceptional items

Profit before exceptional item is Rs.123 crore as against loss of Rs.475 crore y-o-y.

Cash Profit3

Cash Profit3for the year at Rs. 787 crore. Cash profit for the year is impacted by the exceptional cost for international projects, which are sold or called off.

Q4 FY20( Q o Q)

Revenue

Revenue from power generationincreased by 10% to Rs. 601 crore due to increase in operational capacity.

EBITDA and EBITDA Margins

EBITDA1 increase by 10% at Rs. 516 crore. EBITDA margin2 during quarterwas91% compared to 89% Q o Q. Increase in EBITDA1 and margin is attributable to operational efficiency.

Profit/Loss before exceptional items

Profit before exceptional items is Rs. 75 crore as compared to lossof Rs. 94 crore Q o Q.

Top Courses in Software Engineering

Balance Sheet

As on 31stMarch, 2020, Gross debt was at Rs.13,943 crore (Excludes inter corporate deposits and lease liability) and Net debt was Rs.11,470crore (Gross debt less cash and cash equivalents including FD and MF and Power sales receivables).

Projects

The Group has won bids for 130 MW wind and 1,300 MW Hybrid inFY20. Post completion of all the bids won and projects under implementation, the Group’s operational capacity would be 5,9906 MW.

Major Event

During the quarter, Adani Green Energy Limited (Holding Company), Adani Green Energy Twenty Three Limited (Subsidiary of the Holding Company) and TOTAL Solar Singapore Pte Limited (TOTAL) have entered into a Joint Venture Agreement (JVA) to accept 50% approximately 3,700 Crore investment in form of Equity and other instruments from TOTAL for 2148 MW of operational solar projects of the Group. The Board of AGEL dated March 23, 2020 has approved the transactions.

The JVA describes the terms to regulate the operation and management of the subsidiaries companies, govern their relationship as security holders of the JV Company and exercise certain rights and obligations with respect to their ownership of securities of the JV Company.

The said transaction and JV agreement is completed on 7th April, 2020 after receipt of due regulatory and statutory approvals.

Commenting on the quarterly results of the Company, Mr. Gautam Adani, Chairman, Adani Green Energy Limited said, “Adani Group has always maintained sustainability as a priority at the group. With the long-lasting impact that COVID-19 is due to have on all sectors, sustainability driven business is imperative. Green Energy and Renewable Energy motivated investments will continue in this coming fiscal year. At Adani Group, we are committed towards nation building and ensuring electrification for the growth of the economy. We are confident in emerging stronger at the end while delivering value to all stakeholders”

Mr. Jayant Parimal, CEO, Adani Green Energy Ltd said, “Adani Green Energy Limited is determined to cement its place as a leading renewable energy player in India. With our completed mergers and joint ventures, the most recent one being with Total, we have showcased strong performance. COVID-19 disruption has not materially affected the renewable plant operations, billing or collections from counterparties. Renewable energy plants enjoys a must-run status will continue to operate and generate at optimum level, in our assessment. All under-construction activity which was mandatorily suspended during lockdown, is poised to restart, as per GoI guidelines”

About Adani Green Energy

Adani Green Energy Limited, part of the diversified Adani Group, is one of the largest renewable companies in India, with a current project portfolio of 6 GW including under construction capacity. Additionally, AGEL participated, as successful bidder in SECI’s tender of manufacturing linked development project for a capacity of 8 GW and is awaiting its award.

Notes:

- Calculation of EBITDA excludes foreign exchange (gain) / loss ,Other Income and extraordinary items.

- EBITDA margin % represents EBITDA earned from Power Generation and excludes other items. Revenue from Power Generation includes Generation Based Incentive (GBI).

- Cash profit = EBITDA1 + Other Income – Interest and other borrowings cost–current tax including earlier periods.

- Capacity Utilisation Factor is calculated post capitalization.

- Includes units generated during plant stabilization period, against which the revenue has been capitalised during the quarter Rs.3.59 Crore (13 Mu’s) and for FY20 Rs.26.35 Crore (96 Mu’s)

- AGEL has entered in a definitive share purchase agreement to acquire beneficial interest in the OEM wind projects of 150 MW subject to fulfillment of conditions precedent.

For more information related to technology, visit: HawksCode and EasyShiksha

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowQ. Are EasyShiksha's internships truly free?

Yes, all internships offered by EasyShiksha are completely free of charge.

Q. How can I apply for an internship with EasyShiksha?

You can apply by visiting our website, browsing available internships, and following the application instructions provided.

Q. What types of internships are available through EasyShiksha?

EasyShiksha offers a wide range of internships across technology, business, marketing, healthcare, and more. Opportunities are continuously updated.

Q. Will I receive a certificate upon completing an internship?

Yes, upon successful completion, you will receive a certificate recognizing your participation and achievements.

Q. Are EasyShiksha's internship certificates recognized by universities and employers?

Yes, the certificates are recognized by universities, colleges, and employers worldwide.

Q. Is the download of certificates free or paid?

Access to internships and courses is free, but there is a small fee to download certificates, covering administrative costs.

Q. When can I start the course?

You can choose any course and start immediately without delay.

Q. What are the course and session timings?

These are fully online courses. You can learn at any time and pace. We recommend following a routine, but it depends on your schedule.

Q. What will happen when my course is over?

After completion, you will have lifetime access to the course for future reference.

Q. Can I download the notes and study material?

Yes, you can access and download course materials and have lifetime access for future reference.

Q. What software/tools would be needed for the course?

All necessary software/tools will be shared during the training as needed.

Q. I’m unable to make a payment. What should I do?

Try using a different card or account. If the problem persists, email us at info@easyshiksha.com.

Q. Do I get the certificate in hard copy?

No, only a soft copy is provided, which can be downloaded and printed if required.

Q. The payment got deducted but shows “failed”. What to do?

Technical errors may cause this. The deducted amount will be returned to your account in 7-10 working days.

Q. Payment was successful but dashboard shows ‘Buy Now’?

Sometimes payment reflection is delayed. If it takes longer than 30 minutes, email info@easyshiksha.com with the payment screenshot.

Q. What is the refund policy?

If you face technical issues, you can request a refund. No refunds are issued once the certificate has been generated.

Q. Can I enroll in a single course?

Yes, select the course of interest, fill in the details, make payment, and start learning. You will also earn a certificate.

Q. My questions are not listed above. I need further help.

Contact us at info@easyshiksha.com for further assistance.

ALSO READ: as-covid-19-hit-businesses-seek-to-hone-their-problem-solving-skills

Get Course: complete-law-course-for-entrepreneurs