Strong Q3 Performance with

Operational EBITDA of Rs. 1,114 crore, up 37%,

and Consolidated PAT of Rs. 204 crore, up 32% yoy

Strong operational performance with highest order Availability in Transmission business

Ahmedabad, February 13, 2020: Adani Transmission Ltd. (“ATL”), part of the Adani Group, today reported its results for Q3 FY20 and 9M FY20.

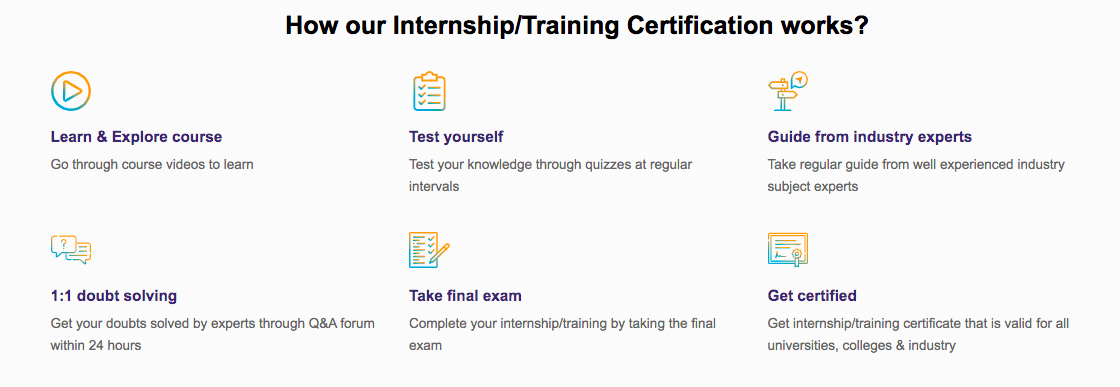

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

Top Courses in Virtual Reality

More Courses With Certification

|

KEY HIGHLIGHTS

|

Key Financials:

AEML was acquired on 29 August, 2018 and included in the company financials from 1 Sept 2018

Notes:

*7 stapled assets include CWRTL, RRWTL, STL, ATRL, PPP-8, PPP-9 and PPP-10

#AEML is the licensee for an integrated power distribution, transmission and generation business that currently serves more than 3 million consumers across a license area of approximately 400 square kilometers in the city of Mumbai, the world’s seventh largest city by size of population. AEML’s market share of Mumbai is approximately 87% by license area, 67% by consumers served and 55% by electricity supplied.

-

Top Courses in Software Engineering Top Courses in Software Engineering

Loading...

Acronyms – LBTL: Lakadia Banaskantha Transco Limited; JKTL: Jam Khambaliya Transco Limited TBCB: Tariff Based Competitive Bidding; AEML: Adani Electricity Mumbai Limited; MSETCL: Maharashtra State Electricity Transmission Company Limited; USPP: United State Private Placement.

Speaking on the performance of the company, Mr. Gautam Adani, Chairman, Adani Group, said, “There is abundant potential and significant growth in India’s transmission sector in the coming years. With the government core focus towards the objective of 24×7 Power for all, Adani Transmission Limited with its widespread network and continuous growth looks forward to expand its business at large. We are increasingly working towards building strong relations between India and other countries via acquisitions and partnerships to ensure improvisation in reliability of power supply and consumer satisfaction in our services. Adani Transmission is striving towards nation building and fueling sustainability and we will continue to explore opportunities for growth by leveraging our strong transmission network”

Mr. Anil Sardana, MD & CEO, Adani Transmission Ltd, said, “Adani Transmission delivered robust financial performance in Q3, with operational EBITDA of Rs. 1,114 crores, up 37%, and consolidated PAT of Rs. 204 crores, up 32% yoy. This was strongly driven by superlative operational performance. With a growing economy, the demand for power has also increased rapidly over the years and with these growth, coupled with Make in India and Smart Cities will further drive power industry at large. Toward this effort, ATL’s focus in FY20 has been in strengthening long-partnerships, expanding our grid network and enhancing customer centricity by supplying power to deficit parts of the country. Our recent acquisitions will make us the country’s largest private sector transmission company in India. Through leveraging technology, innovation and commitment to transmitting bulk green power, we always make efforts to deliver and fuel country’s power demands”

About Adani Transmission Ltd.

Adani Transmission (ATL) is the transmission and distribution (T&D) business arm of the Adani Group, one of India’s largest business conglomerates. It is the country’s largest private transmission company with a cumulative transmission network of more than 14,738 ckt kms, out of which more than 11,477 ckt kms is operational. This includes around 3,261 ckt kms in various stages of construction. ATL also operates a distribution business serving about 3 million+ customers in Mumbai. With India’s energy requirement set to quadruple in coming years, Adani Transmission is fully geared to create a strong and reliable power transmission network and work actively towards achieving ‘Power for All’ by 2022.

Top Courses in Networking

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowQ. Are EasyShiksha's internships truly free?

Yes, all internships offered by EasyShiksha are completely free of charge.

Q. How can I apply for an internship with EasyShiksha?

You can apply by visiting our website, browsing available internships, and following the application instructions provided.

Q. What types of internships are available through EasyShiksha?

EasyShiksha offers a wide range of internships across technology, business, marketing, healthcare, and more. Opportunities are continuously updated.

Q. Will I receive a certificate upon completing an internship?

Yes, upon successful completion, you will receive a certificate recognizing your participation and achievements.

Q. Are EasyShiksha's internship certificates recognized by universities and employers?

Yes, the certificates are recognized by universities, colleges, and employers worldwide.

Q. Is the download of certificates free or paid?

Access to internships and courses is free, but there is a small fee to download certificates, covering administrative costs.

Q. When can I start the course?

You can choose any course and start immediately without delay.

Q. What are the course and session timings?

These are fully online courses. You can learn at any time and pace. We recommend following a routine, but it depends on your schedule.

Q. What will happen when my course is over?

After completion, you will have lifetime access to the course for future reference.

Q. Can I download the notes and study material?

Yes, you can access and download course materials and have lifetime access for future reference.

Q. What software/tools would be needed for the course?

All necessary software/tools will be shared during the training as needed.

Q. I’m unable to make a payment. What should I do?

Try using a different card or account. If the problem persists, email us at info@easyshiksha.com.

Q. Do I get the certificate in hard copy?

No, only a soft copy is provided, which can be downloaded and printed if required.

Q. The payment got deducted but shows “failed”. What to do?

Technical errors may cause this. The deducted amount will be returned to your account in 7-10 working days.

Q. Payment was successful but dashboard shows ‘Buy Now’?

Sometimes payment reflection is delayed. If it takes longer than 30 minutes, email info@easyshiksha.com with the payment screenshot.

Q. What is the refund policy?

If you face technical issues, you can request a refund. No refunds are issued once the certificate has been generated.

Q. Can I enroll in a single course?

Yes, select the course of interest, fill in the details, make payment, and start learning. You will also earn a certificate.

Q. My questions are not listed above. I need further help.

Contact us at info@easyshiksha.com for further assistance.

ALSO READ: iiit-delhi-partners-with-extramarks-to-encourage-research-in-ai

Get Courrse: Learn-SQL-Tutorial-for-Beginners