Editor’s Synopsis:

- IIM Udaipur launched a unique student-driven initiative that focuses on developing and managing an investment fund that will invest in ventures focusing on generating environmental and social impact while giving risk adjusted financial returns. It is India’s first such student-driven Impact Investment Fundand an affirmation of IIMU’s initiatives that are encapsulated in their hashtag #ItStartsAtU

- Ventures in 5 of the United Nations Sustainable Development Goals to be supported

- Collaboration planned with global Ivy League colleges having similar funds, like Stanford GSB, UCLA Anderson, Microlumbia, etc.

- Investees will get access to the IIMU ecosystem of mentors, professors, and functional clubs for consultation and use the talent pool for internships and live projects

- Fund Size estimated to be 7 Crores in 5 years. Initial investments are already received to the tune of INR 45 lakhs from the Transworld Group and Mr. Yogesh Andlay.

February 03, 2022; Udaipur: Indian Institute of Management Udaipur (IIM Udaipur) launched a student-managed Impact Investment Fund (IIF) focusing on investing in early-stage projects or start-ups that create a social and environmental impact on society. The Impact Investment Fund (IIF) initiative aims to support entrepreneurs who have the potential to leverage their expertise and skills to create an impact for the society and environment in a sustainable manner. Ventures will be supported in 5 Goals from the United Nations Sustainable Development Goals – viz, Zero Hunger, Good Health & Well Being, Quality Education, Clean Water & Sanitation and Affordable & Clean Energy

IIF shall play an important role by bridging the gap between potential investors in social entrepreneurship and entrepreneurs by scouting the Indian market, understanding the objectives of both investors and entrepreneurs, aligning the fund’s objective of creating an impact, and awarding the fund to the entrepreneur along with the knowledge and operational support. IIF recognizes the industry of the project, the benefit of the product or service, and evaluates the impact it will have on society and the environment.

The Fund will be an ‘Evergreen Fund’, operating financially within IIMU IC as a Section 8 Company, with provision for co-investing. Fund size is estimated to be 7 Crores in 5 years. Approximately 12-17 companies will be invested in at any point of time. Individual Investments are capped at 15% of fund size or Rs.40 lakhs.

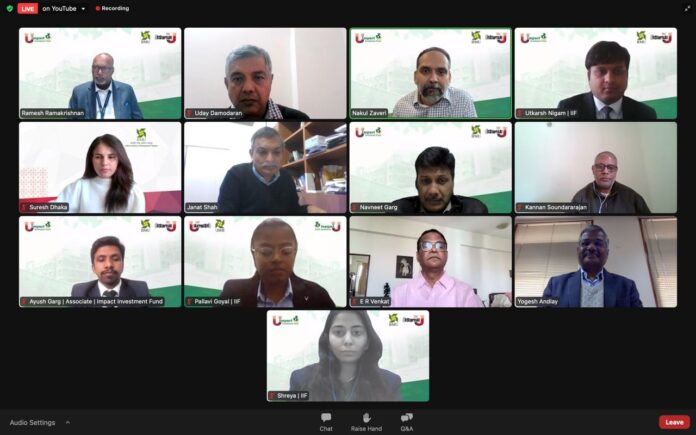

The launch was announced through a webinar in which Mr. Nakul Zaveri, Managing Partner, Relativity Investment Management, Mr. Navneet Garg, CEO and Co-Founder Caya Constructs, and Mr. Ramesh S. Ramakrishnan, Chairman, Transworld Group of Companies, spoke,.

In his address Mr Ramakrishanan said, “When patterns are broken new worlds emerge. Evolution and growth are the only stimulants that keep us moving and impact projects are going to be agents of change to bring. There has been an increased shift towards sustainability by investors globally in the last five years. At Transworld Group, the higher purpose of ‘Delivering Prosperity to Humanity’ is our guiding light motivating us in our endeavour to be a channel of prosperity not just our shareholders or staff, but to an all-encompassing constituent covering our associates, humanity and the entire ecosystem. As investors, it is our responsibility to support impact investments that support social development and would help to achieve the United Nation’s Sustainable Development Goals (SDGs) by 2030.”

Mr. Nakul Zaveri discussed the three most important things that impact should be aligned with. The impact should be globally acceptable while also being relevant to national/regional context and adhering to standard metrics. He highlighted the importance of generating impact at scale, terminal value of a business, and of using relevant frameworks and metrics in impact investment.

Mr. Navneet Garg advised that looking for the right business model before investing is crucial for any impact investment. He also said that doing good is good business. It must be the essence of what we do. The focus should not only be on impact, but it should also be on sustainability as well as generating financial returns.

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

Mr. Yogesh Andlay said, “Social businesses have the potential of large-scale transformation and improve the quality of lives of millions of people. IIMU Impact Investment Fund sourced and managed by the students of IIM Udaipur is targeted towards seeding and catalysing such social innovative businesses.

This fund will provide an experiential learning opportunity to the students to understand Environment, Sustainability and Governance issues. And build their capabilities to become wholesome servant leaders having empathy, selflessness, and humility.”

On the launch of this initiative, Prof. Janat Shah, Director, IIM Udaipur, said, ” It is a matter of great pride and satisfaction to see this student-driven initiative take seed in India through the commitment and passion of our young students to societal good. It will help make a positive social impact through the venture investment and mentorship support it provides. Importantly, it will also give the students an opportunity to put their classroom learnings to a practical, socially relevant application, as they identify, mentor and grow the ventures to also deliver reasonable returns to fund investors. It is an intrinsically valuable lesson to imbibe as a future business leader. I hope this inspires students from other institutions in India to also take this up”

The B-school further mentioned the impact investment fund is to create an impact benefitting society and our environment. Being the first student-led impact investment fund in India, intends to promote a culture of impact investing in India by spreading awareness and inspiration to other institutes.

Working with a Board of Directors, and Advisory Committees, all Fund operations, investments and exits will be managed by the Students. The Founding Student Team has 18 members.

Top Courses in Software Engineering

More Courses With Certification

IIF is also looking at collaborating with Global Impact Fund Collaborative, which has 11 institutes as a part of it (inclusive of IIMU), The institutes that are a part of the collaboration are, Berkeley – Haas Impact Fund, Chicago Booth – Tarrson Impact Investment Fund, Columbia – Microlumbia, Dartmouth – Tuck Social Venture Fund, Duke – Fuqua Sustainable Impact Fund, HBS – Harbus Foundation, IFIC – IESE Impact Investing Fund, LBS – Student Impact Investing Fund, Michigan

– Michigan Climate Venture Fund, Michigan – Social Venture Fund, Stanford – GSB Impact Fund, UCLA – Anderson Venture Impact Partners, and Wharton – Wharton Impact Investing Partners.

ALSO READ: Times Professional Learning, Indian Institute of Management Kashipur

Want to improve your skill visit: EasyShiksha