06 March, 2019, Bengaluru: Indian Institute of Management Bangalore (IIMB) has signed two Memorandums of Understanding (MoU) with the Commercial Taxes Department (CTD), Government of Karnataka, on March 06 (Wednesday), 2019, one for capacity building programmes for the CTD officers for three years in IIMB, and another collaborative MoU for Big Data Analytics for tax administration. This approach of the department makes tax administration more data driven, with IIMB’s support to the Government to bring professionalism in tax administration.

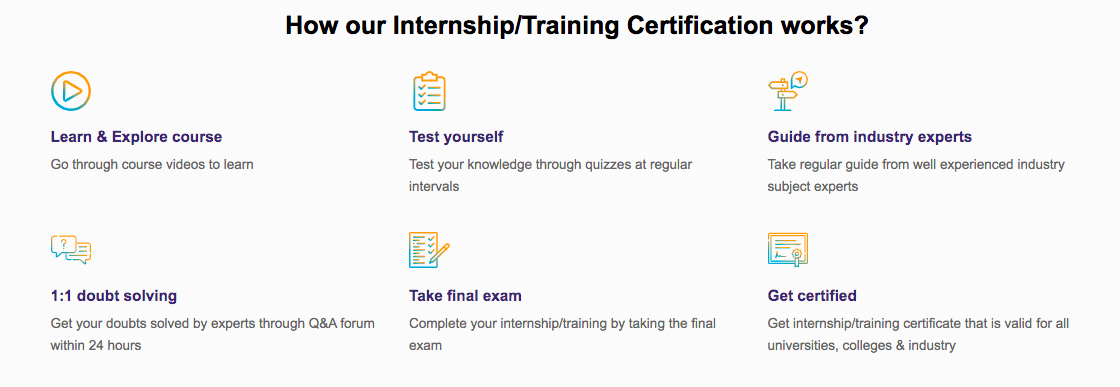

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

This is a paradigm shift in the approach of the Government of Karnataka with its vision for the future, to stabilise tax administration supported by IIMB, to bring professionalism in tax administration and to build a platform for CTD for big data analytics for revenue stabilisation by providing solutions through research analysis.

In the background of introduction of Goods and Services Tax (GST) in the country, there was a need to upgrade the skills of officers of the CTD to have new orientation towards GST as the new law has been totally IT driven.

Usage of technological innovation, business analytics, data driven decision making skills and management of tax administration in a more professional manner were the need of the hour.

IIMB was approached by CTD in May 2018 in consultation with the Government of Karnataka, as IIMB is a premier institution in the country and professionally equipped to handle and impart management development skills, Big Data Analytics, forecasting revenue, preparation of watertight investigations, reinvention, transformation and other critical areas of empowerment required to upgrade the skills of the officers.

Thereafter, IIMB conducted training for 123 senior management-level officers during the current financial year. The professional approach of IIMB faculty helped CTD realize the objective of capacity building and the Government of Karnataka granted permission to the Commercial Taxes Department to undertake training for 360 officers for the next three years, with 120 officers per financial year.

To undertake the Capacity Building Programme with module-based training to further the economic perspective, and to enhance the managerial ability and efficiency of the officers of the CTD, IIMB would design and conduct training programmes for CTD officers.

One of the important learnings from IIMB by the officers has been the importance of Big Data analytics in tax administration.

Expertise of IIMB in Big Data Analytics, NIC’s software skills and CTDs domain knowledge could form a symbiotic relationship to achieve the desired objectives. Government of Karnataka has also accorded permission to CTD to undertake Big Data Analytics on GST data to find insight in collaboration with IIMB.

Top Courses in Software Engineering

About the MoUs

The first MoU has been signed between Executive Education Programmes (EEP) at IIMB and CTD, and focusses on capacity building programmes for CTD officers focusing on managerial skills, Big Data, forecasting revenue, undertaking investigations, building economic perspectives, and other critical areas that are meant to improve the managerial ability and efficiency of officers of CTD, in this transition period of tax administration from VAT to GST. The IIMB Programme Directors are Professor Arnab Mukherji and Professor Anil B Suraj, both from the Public Policy area. The duration is of three years.

Prof. Arnab Mukherji of IIMB, while explaining the relevance of the MoU, said: “GST is a new era of commercial tax administration that needs dynamic and proactive administration authority that needs to be well prepared. The training MoU will bring in the best of ideas and practice, and focus on change among officers at CTD to constructively manage the ever-changing status quo for commercial tax collection.”

Hailing the collaboration with IIMB, M S Srikar, Commissioner of Commercial Taxes, Government of Karnataka, said: “Equipping our officers to effectively implement and spearhead GST implementation in Karnataka required a well-designed and holistic capacity building programme. Our association with IIM Bangalore to create and implement such a programme was highly successful during 2018-19. Based on these learnings, we are excited to enter into an MoU with IIMB for a comprehensive GST training programme for our senior and middle-level officers”.

Prof. Anil B Suraj highlighted the role of the MoU by saying: “In an era of GST, the tax-man must not only understand the tax laws, but also the way the economy and society functions, interpret emerging laws that have bearing on tax administration, and also play leadership roles within the commercial taxes department.”

The second MoU was signed between Principal Investigators from IIMB – Professor Pulak Ghosh, faculty from the Decision Sciences and Professor Arnab Mukherji from the Public Policy area, and CTD. For this, CTD would focus on using various aspects of Big Data Analytics and state-of-the-art machine learning algorithms to derive various insights, including fraud analytics, sectoral patterns, hot-spot mapping for revenue collection, understanding effects of economic policy on GST revenue collections, etc. This exercise will help the tax administration for the Government of Karnataka to get more insight and understanding. The duration is of two years.

Prof. Pulak Ghosh set the context of the MoU by saying: “Insights from Big Data and ML are being increasingly used to identify trends, sectoral challenges, and informs corporate decision making and government policy in many national and international fora. A careful analysis of the GST data not only has the ability to improve revenue collection, but also to identify policy experiments that help the government meet its goals. IIMB being the leader in the analytics space is very happy to be part of this with CTD. This is the first-ever such initiative on GST in the country. ”

M S Srikar said, “Tax administration under GST must harness the latest tools, learnings and research on big data analytics in order to be more effective and efficient. The Commercial Taxes Department, along with technical support from the National Informatics Centre (NIC), has embarked on collaboration with IIMB to explore the possibility of utilizing data analytics to improve administration”.

Prof. Arnab Mukherji added, “Tax administration and fiscal space are closely intertwined. Analytics exploiting the Big Data underlying the GST Network has the potential to not only increase fiscal space, but also to make taxation more predictable and simpler.”

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowQ. Are EasyShiksha's internships truly free?

Yes, all internships offered by EasyShiksha are completely free of charge.

Q. How can I apply for an internship with EasyShiksha?

You can apply by visiting our website, browsing available internships, and following the application instructions provided.

Q. What types of internships are available through EasyShiksha?

EasyShiksha offers a wide range of internships across technology, business, marketing, healthcare, and more. Opportunities are continuously updated.

Q. Will I receive a certificate upon completing an internship?

Yes, upon successful completion, you will receive a certificate recognizing your participation and achievements.

Q. Are EasyShiksha's internship certificates recognized by universities and employers?

Yes, the certificates are recognized by universities, colleges, and employers worldwide.

Q. Is the download of certificates free or paid?

Access to internships and courses is free, but there is a small fee to download certificates, covering administrative costs.

Q. When can I start the course?

You can choose any course and start immediately without delay.

Q. What are the course and session timings?

These are fully online courses. You can learn at any time and pace. We recommend following a routine, but it depends on your schedule.

Q. What will happen when my course is over?

After completion, you will have lifetime access to the course for future reference.

Q. Can I download the notes and study material?

Yes, you can access and download course materials and have lifetime access for future reference.

Q. What software/tools would be needed for the course?

All necessary software/tools will be shared during the training as needed.

Q. I’m unable to make a payment. What should I do?

Try using a different card or account. If the problem persists, email us at info@easyshiksha.com.

Q. Do I get the certificate in hard copy?

No, only a soft copy is provided, which can be downloaded and printed if required.

Q. The payment got deducted but shows “failed”. What to do?

Technical errors may cause this. The deducted amount will be returned to your account in 7-10 working days.

Q. Payment was successful but dashboard shows ‘Buy Now’?

Sometimes payment reflection is delayed. If it takes longer than 30 minutes, email info@easyshiksha.com with the payment screenshot.

Q. What is the refund policy?

If you face technical issues, you can request a refund. No refunds are issued once the certificate has been generated.

Q. Can I enroll in a single course?

Yes, select the course of interest, fill in the details, make payment, and start learning. You will also earn a certificate.

Q. My questions are not listed above. I need further help.

Contact us at info@easyshiksha.com for further assistance.

ALSO READ: Womens-day-quote-by-powerful-women-and-celebrity-actress

Get Course: Java-Tutorial-for-Beginners-Course