Cryptocurrencies resumed their slump on Monday, together with bitcoin falling under the US$5,000 mark for the first time since October 2017, in the wake of increased regulatory scrutiny of initial coin offerings and also the rest of one of the biggest tokens.

Data accumulated by the Coinbase digital trade showed the world’s most popular digital currency losing 12.5 percent of its value from Friday evening to endure at $4,914.21 by 1930 GMT Monday. The still-nascent marketplace is not completely clear and analysts have struggled to comprehend what prompted the latest selloff. Bitcoin’s all-time high of $19,511 was listed last year on December 18, 2017.

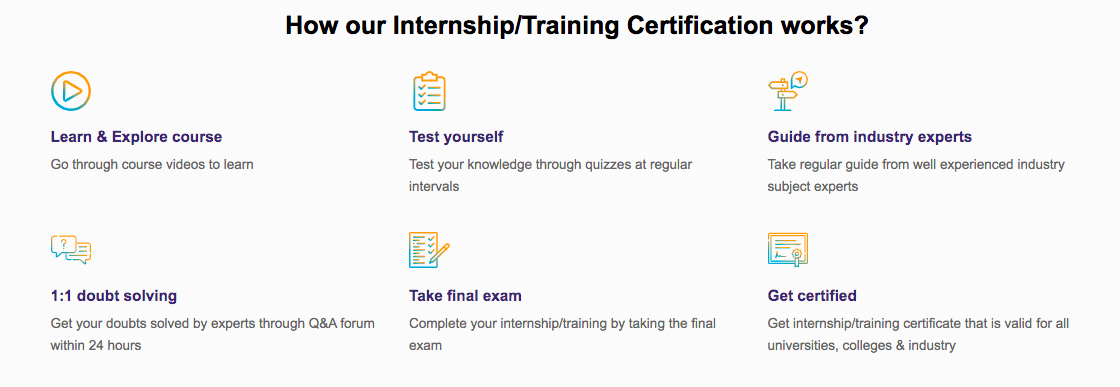

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

Bitcoin declined as much as 9 percent to $4,958, while so alternative coins slumped even more, with Ether tumbling up to 12 percentage and Litecoin cratering as much as 13 percent. XRP, the token associated with Ripple, was the lone gainer among leading digital currencies. The Bloomberg Galaxy Crypto Index fell as much as 8.3 percent to a one-year-low on a closing basis.

The so-called alternative coins slumped even more, with Ether tumbling up to 13 percent and Litecoin cratering up to 14%. XRP, the token associated with Ripple, was the only gainer among major digital currencies.

On Friday, the US SEC announced its first civil penalties against two cryptocurrency companies that didn’t register their first coin offerings.

“The selloff is related to authorities, which is almost completely underway,” said Justin Litchfield, chief technology officer at ProChain Capital. ” Projects are being forced to reunite investor money, which, after having spent a whole lot of money advertising their $100 million ICO to a lavish party-filled road-show which was the norm for this classic of ICOs, will be hard.”

The investment instruments basically operate as a stock that closely monitors each bitcoin’s market worth.

ETFs are among the most popular trading mechanisms as well as the SEC’s green light would give the bitcoin market a huge infusion of external cash. However, the SEC has so far balked from worries about fraud.

Top Courses in Software Engineering

A number of the losses since Wednesday have been linked to a warning against the accounting group KPMG last week about the dangers of seeing bitcoin as a true money. “To meet the needs ‘store of value’, cryptocurrencies have to be much more secure,” the KPMG report said.

“Extending charge in a currency which dangers significant devaluation or borrowing in the event the value appreciated beyond the borrower’s capacity to pay is a fool’s errand,” stated the report.

——————————————————————————————————————————————-

Get free online test series for exams like Bank PO cleark and SSC, Railway with EasyShiksha. Sign up and get a free account for every mock test. With EasyShiksha free account you can access free online courses and career helper. Press the bell icon for latest Govt. Jobs, Tech, Sports, Results and Current Affairs updates.

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowQ. Are EasyShiksha's internships truly free?

Yes, all internships offered by EasyShiksha are completely free of charge.

Q. How can I apply for an internship with EasyShiksha?

You can apply by visiting our website, browsing available internships, and following the application instructions provided.

Q. What types of internships are available through EasyShiksha?

EasyShiksha offers a wide range of internships across technology, business, marketing, healthcare, and more. Opportunities are continuously updated.

Q. Will I receive a certificate upon completing an internship?

Yes, upon successful completion, you will receive a certificate recognizing your participation and achievements.

Q. Are EasyShiksha's internship certificates recognized by universities and employers?

Yes, the certificates are recognized by universities, colleges, and employers worldwide.

Q. Is the download of certificates free or paid?

Access to internships and courses is free, but there is a small fee to download certificates, covering administrative costs.

Q. When can I start the course?

You can choose any course and start immediately without delay.

Q. What are the course and session timings?

These are fully online courses. You can learn at any time and pace. We recommend following a routine, but it depends on your schedule.

Q. What will happen when my course is over?

After completion, you will have lifetime access to the course for future reference.

Q. Can I download the notes and study material?

Yes, you can access and download course materials and have lifetime access for future reference.

Q. What software/tools would be needed for the course?

All necessary software/tools will be shared during the training as needed.

Q. I’m unable to make a payment. What should I do?

Try using a different card or account. If the problem persists, email us at info@easyshiksha.com.

Q. Do I get the certificate in hard copy?

No, only a soft copy is provided, which can be downloaded and printed if required.

Q. The payment got deducted but shows “failed”. What to do?

Technical errors may cause this. The deducted amount will be returned to your account in 7-10 working days.

Q. Payment was successful but dashboard shows ‘Buy Now’?

Sometimes payment reflection is delayed. If it takes longer than 30 minutes, email info@easyshiksha.com with the payment screenshot.

Q. What is the refund policy?

If you face technical issues, you can request a refund. No refunds are issued once the certificate has been generated.

Q. Can I enroll in a single course?

Yes, select the course of interest, fill in the details, make payment, and start learning. You will also earn a certificate.

Q. My questions are not listed above. I need further help.

Contact us at info@easyshiksha.com for further assistance.

ALSO READ: iiit-delhi-professor-dr-mayank-vatsa-selected-for-prestigious

Get Course: Programming-with-NodeJS-ExpressJS