Global imports of wearable devices attained 32 million units in the next quarter of 2018 — up 21.7 percent in the preceding year, according to IDC’s”Worldwide Quarterly Wearables Market Device Tracker”.

Though China accounts for well over 80% of the shipment quantity of Xiaomi, that share fell to 61% as the company was able to increase its presence in markets like Europe, India, Middle East, and Africa.

Xiaomi sent 6.9 million wearables as compared to 4.2 million by Apple. Fitbit at third position shipped 3.5 million wearables.

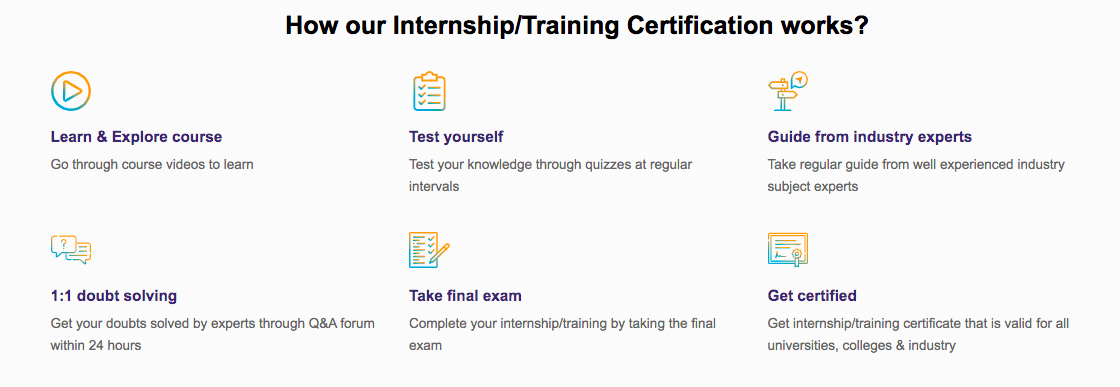

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

The overall wearables imports dropped 11 percent from the previous quarter largely because of the double-digit decrease from the basic wearables, showed statistics from IDC’s”Quarterly Wearables Tracker”.

“It’s too premature to say that the India wearables marketplace has started moving towards the wise wearables,” explained Jaipal Singh, Associate Research Manager, Client Devices, IDC India.

“However, vendors have begun assessing the huge pricing gaps between the fundamental and smart wearables,” Singh explained.

The entire India wearables market saw a 17 percent year-over-year (YoY) growth in the third quarter of the year as vendors shipped a total of 897,000 units from the nation, the report said.

Top Courses in Software Engineering

The smart wearables, generally described as wearables which may run third-party applications on its own, saw two successive quarters of double-digit growth and sent 102,000 units in Q3 2018, which makes it the first quarter to cross the 100,000 units dispatch mark in the nation, the report said.

“While vendors need to recognize a new pricing sweet spot for smartwatches, the next challenge is to address the positioning of watches which is still regarded as a vanity product in India,” Singh explained.

“Also, many vendors haven’t researched the kid segment which may be a volume driver for this category as they are more comfortable with technology and new goods,” he added.

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowQ. Are EasyShiksha's internships truly free?

Yes, all internships offered by EasyShiksha are completely free of charge.

Q. How can I apply for an internship with EasyShiksha?

You can apply by visiting our website, browsing available internships, and following the application instructions provided.

Q. What types of internships are available through EasyShiksha?

EasyShiksha offers a wide range of internships across technology, business, marketing, healthcare, and more. Opportunities are continuously updated.

Q. Will I receive a certificate upon completing an internship?

Yes, upon successful completion, you will receive a certificate recognizing your participation and achievements.

Q. Are EasyShiksha's internship certificates recognized by universities and employers?

Yes, the certificates are recognized by universities, colleges, and employers worldwide.

Q. Is the download of certificates free or paid?

Access to internships and courses is free, but there is a small fee to download certificates, covering administrative costs.

Q. When can I start the course?

You can choose any course and start immediately without delay.

Q. What are the course and session timings?

These are fully online courses. You can learn at any time and pace. We recommend following a routine, but it depends on your schedule.

Q. What will happen when my course is over?

After completion, you will have lifetime access to the course for future reference.

Q. Can I download the notes and study material?

Yes, you can access and download course materials and have lifetime access for future reference.

Q. What software/tools would be needed for the course?

All necessary software/tools will be shared during the training as needed.

Q. I’m unable to make a payment. What should I do?

Try using a different card or account. If the problem persists, email us at info@easyshiksha.com.

Q. Do I get the certificate in hard copy?

No, only a soft copy is provided, which can be downloaded and printed if required.

Q. The payment got deducted but shows “failed”. What to do?

Technical errors may cause this. The deducted amount will be returned to your account in 7-10 working days.

Q. Payment was successful but dashboard shows ‘Buy Now’?

Sometimes payment reflection is delayed. If it takes longer than 30 minutes, email info@easyshiksha.com with the payment screenshot.

Q. What is the refund policy?

If you face technical issues, you can request a refund. No refunds are issued once the certificate has been generated.

Q. Can I enroll in a single course?

Yes, select the course of interest, fill in the details, make payment, and start learning. You will also earn a certificate.

Q. My questions are not listed above. I need further help.

Contact us at info@easyshiksha.com for further assistance.

ALSO READ: Samsung-galaxy-note-9-snow-white-variant-looks-set

Get Course: Android-Apps-Development