- Offers early liquidity starting from 1st Policy year*

- Enhanced protection benefits through Policy Continuance Benefit and additional accidental cover

- Additional benefit on maturity to female lives++ and discount+ to transgender customers

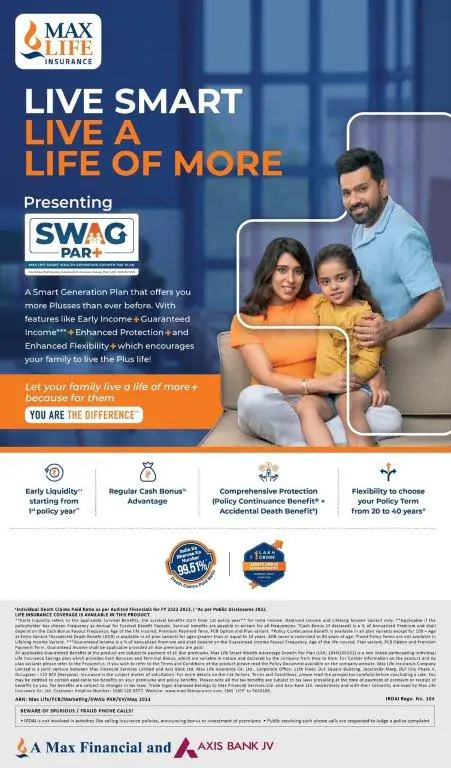

New Delhi, June 8, 2023: Max Life Insurance Company Ltd. (“Max Life” / “Company”), has launched Smart Wealth Advantage Growth Par Plan (UIN – 104N135V01) – A Non-Linked Participating Individual Life Insurance Savings Plan. The plan combines the power of ‘Protection, Liquidity, and Flexibility’ into a simple solution and offers comprehensive financial protection for the family for key milestones in life, including retirement.

ALSO READ: Here is how you can protect yourself from heat stroke and heat exhaustion

With its six big benefits, the Smart Wealth Advantage Growth Par Plan enables customers to fulfill their retirement goals while assuring comprehensive protection for themselves and their loved ones:

- Liquidity: Insta Income with enhanced early-liquidity benefits, enabling access to funds from the first policy year

- Guaranteed component: Guaranteed Income** based benefits to ensure predictability of returns for the customer

- Cash Bonus: A percentage of annualized premium shall be payable to the policyholder as a Cash Bonus (if declared)

- Retirement income: Assists in planning for retirement by offering an enhanced income with minimum guarantee during life’s golden years (after the life insured attains the age of 65 years)

- Flexibility: Offers flexibility to opt from 4 income designs with the option to receive income on special days e.g. birthdays, anniversaries, etc., or to accumulate for future needs and withdraw basis requirement

- Enhanced protection benefits: Offered through Policy continuance benefit, inbuilt additional accidental benefit and optional riders

Prashant Tripathy, Managing Director & CEO, Max Lifesaid, “Customer obsession is in Max Life’s DNA, and developing flexible products that respond to evolving consumer needs is our core competency. Werecognized the emerging need for a well-designed income plan emphasizing the Wealth value of a regular additional income for long-term financial stability. With Smart Wealth Advantage Growth Par Plan, our primary objective is to offer a comprehensive savings plan, which provides lasting income assurance during the years when one needs it the most.”

Promoting financial inclusivity, the Smart Wealth Advantage Growth Par Plan extends special discounts to transgender customers+ and additional benefits on maturity for women++. With these measures, Max Life reaffirms its dedication to fostering a more inclusive and equitable society through innovative insurance offerings.

Key Product features:

| Four variants to build an income stream | Choose between Insta Income, Balanced Income, Future Income, or Lifelong Income variants available. All these options come with inbuilt guarantees and cash bonuses (if declared), and a life cover for the entire policy term |

| Enjoy Enhanced Income with Lifelong Income Option | Post-attainment of age 65 under the Lifelong Income option for the life insured, the customer will receive an enhanced income till the end of the policy term |

| Choice of premium payment term and policy term | Flexibility to choose from various premium payment terms and avail life cover starting from 20 to 40 years and ranging up to age 100 years |

| Enhanced protection through optional riders, Policy Continuance Benefit (PCB), and additional accidental benefit | Option to customize protection cover by opting for riders by paying a small amount of extra premiumPolicy Continuance Benefit, if opted, ensures survival and maturity benefits continue to be paid to the nominee(s), as and when due, in case of death of the Life Insured without any need for future premium payments Additional accidental death benefit cover of 50% of the sum assured is provided after the premium payment term |

| Choose how you like to take payouts: “Save the date”, “Accrual” of survival benefit, and “Premium Offset” | With the “Save the Date” option one can choose to take annual survival benefits on any special date in a yearOption to accrue survival benefits with the company in case the customer wants to save it for future requirements. Option to use the survival benefits to offset against the due premiums and reduce the next premium obligations |

| Discounts and special benefits | Discount on first-year premium and additional benefits like existing customer discounts, staff discounts, transgender lives discounts, and additional benefits on maturity for female lives |

| Option to avail Loans | The option to avail loans against the policy in case of financial emergencies |

Recently, Max Life announced its highest-ever participating (PAR) bonus of Rs. 1,604 Cr. for its eligible policyholders in FY22-23. This is the Company’s 21st consecutive annual bonus; ~8% higher than the bonus declared in the last fiscal. The declared annual bonus will be added to benefits of approximately 21,00,000 (21 lakhs) eligible participating policyholders, aiding their long-term financial goals.

About Max Life Insurance Max Life Insurance Company Limited is a Joint Venture between Max Financial Services Limited and Axis Bank Limited. Max Financial Services Ltd. is a part of Max Group. Max Life offers comprehensive protection and long-term savings life insurance solutions, through its multi-channel distribution including agency and third-party distribution partners. Max Life has built its operations over two decades through a need-based sales process, a customer-centric approach to engagement and service delivery and trained human capital. As per annual audited financials for FY2022-23, Max Life has achieved a gross written premium of INR 25,342 Cr.

This year educate yourself and develop your career with EasyShiksha