- Rajnish Kumar is erstwhile Chairman of India’s largest bank – State Bank of India

- Rajnish to Mentor the BharatPe team on their path to forming a SFB

New Delhi, October 12, 2021: BharatPe, India’s fastest growing Fintech company, today announced the appointment of Rajnish Kumar on its Board. Rajnish Kumar, one of the most respectable names in the banking industry in India and erstwhile Chairman of SBI, will also be the Chairman of Board. Rajnish will be involved in defining the Company’s short-term and long-term strategy, and also will work closely with the other Board Members and CXOs on key business and regulatory initiatives. He will also advice and counsel the Management on matters around business performance as well as corporate governance.

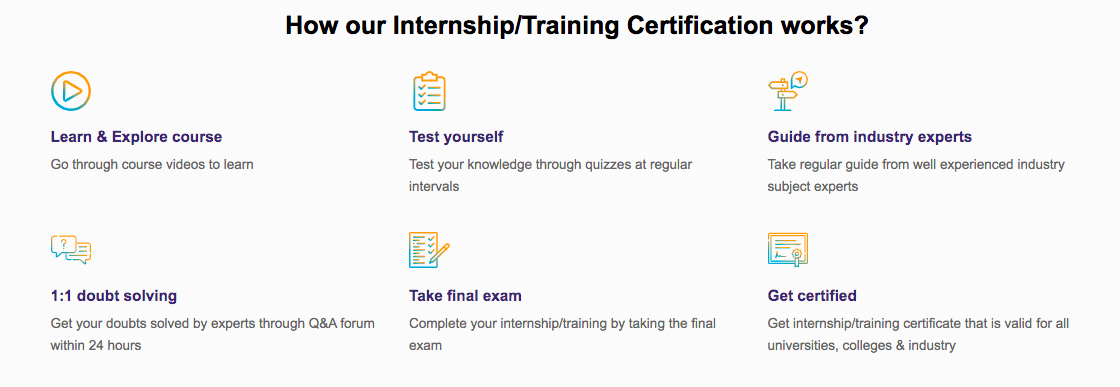

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

Q. Are EasyShiksha's internships truly free?

Yes, all internships offered by EasyShiksha are completely free of charge.

Q. How can I apply for an internship with EasyShiksha?

You can apply by visiting our website, browsing available internships, and following the application instructions provided.

Q. What types of internships are available through EasyShiksha?

EasyShiksha offers a wide range of internships across technology, business, marketing, healthcare, and more. Opportunities are continuously updated.

Q. Will I receive a certificate upon completing an internship?

Yes, upon successful completion, you will receive a certificate recognizing your participation and achievements.

Q. Are EasyShiksha's internship certificates recognized by universities and employers?

Yes, the certificates are recognized by universities, colleges, and employers worldwide.

Q. Is the download of certificates free or paid?

Access to internships and courses is free, but there is a small fee to download certificates, covering administrative costs.

Q. When can I start the course?

You can choose any course and start immediately without delay.

Q. What are the course and session timings?

These are fully online courses. You can learn at any time and pace. We recommend following a routine, but it depends on your schedule.

Q. What will happen when my course is over?

After completion, you will have lifetime access to the course for future reference.

Q. Can I download the notes and study material?

Yes, you can access and download course materials and have lifetime access for future reference.

Q. What software/tools would be needed for the course?

All necessary software/tools will be shared during the training as needed.

Q. I’m unable to make a payment. What should I do?

Try using a different card or account. If the problem persists, email us at info@easyshiksha.com.

Q. Do I get the certificate in hard copy?

No, only a soft copy is provided, which can be downloaded and printed if required.

Q. The payment got deducted but shows “failed”. What to do?

Technical errors may cause this. The deducted amount will be returned to your account in 7-10 working days.

Q. Payment was successful but dashboard shows ‘Buy Now’?

Sometimes payment reflection is delayed. If it takes longer than 30 minutes, email info@easyshiksha.com with the payment screenshot.

Q. What is the refund policy?

If you face technical issues, you can request a refund. No refunds are issued once the certificate has been generated.

Q. Can I enroll in a single course?

Yes, select the course of interest, fill in the details, make payment, and start learning. You will also earn a certificate.

Q. My questions are not listed above. I need further help.

Contact us at info@easyshiksha.com for further assistance.

Rajnish Kumar is one of the most respectable names in the Indian banking industry. An industry veteran, he has held the position of Chairman of the State Bank of India. He became the Chairman of State of Bank of India in October 2017 and ended his three-year term in October 2020. He has also served as Managing Director (National Banking Group), and the Managing Director (Compliance & Risk) of SBI. The senior bank official previously also headed the SBI Capital Markets Limited (the Merchant Banking arm of State Bank of India) as Managing Director and Chief Executive Officer, prior to becoming Managing Director in SBI. He is also an independent non-executive director at HSBC Bank, Asia and L&T Infotech.

Commenting on the appointment, Ashneer Grover, Co-Founder and Managing Director, BharatPe said, “It is a matter of great validation and pride for us that one of the biggest stalwarts of the Indian Banking Industry has agreed to join BharatPe as the Chairman of the Board. We look forward to invaluable guidance from Rajnish Kumar as we build India’s largest digital credit provider. We are confident that under his able guidance, BharatPe will attain newer heights and build the best-in-class Fintech for the new India.”

Added Rajnish Kumar, “In just 3 years, BharatPe has come a long way in becoming a trusted name in the financial services industry. It has redefined payments with its products like interoperable QR and has also emerged as the largest B2B lender in the industry. This company has a huge opportunity ahead and it would be great to work closely with its young and talented team to build financial services for the India of tomorrow.”

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowAbout BharatPeBharatPe was co-founded by Ashneer Grover and Shashvat Nakrani in 2018 with the vision of making financial inclusion a reality for Indian merchants. In 2018, BharatPe launched India’s first UPI interoperable QR code, the first zero MDR payment acceptance service. In 2020, post-Covid, BharatPe also launched India’s only zero MDR card acceptance terminals – BharatSwipe. Currently serving over 70 lakh merchants across 140+ cities, the company is a leader in UPI offline transactions, processing 11 crores+ UPI transactions per month (annualized Transaction Processed Value of US$ 11+ Bn). The company has already facilitated disbursement of loans totaling to over Rs. 2,200 crores to its merchants, since launch. BharatPe’s POS business processes payments of over Rs. 1,400 crores/ month. BharatPe has raised close to US$ 600 million in equity and debt, till date. The company’s list of marquee investors includes Tiger Global,Dragoneer Investment Group, Steadfast Capital, Coatue Management, Ribbit Capital, Insight Partners, Steadview Capital, Beenext, Amplo and Sequoia Capital. In June 2021, the company announced the acquisition of PAYBACK India, the country’s largest multi-brand loyalty program company with 100 million+ members. In June 2021, it was also given an in-principle approval by Reserve Bank of India to establish a Small Finance Bank, in partnership with Centrum Financial Services Limited (Centrum), the established and profitable NBFC arm of the Centrum Group.

For more related content visit Easyshiksha and Hawkscode

ALSO READ: jio-haptik-launches-interakt-a-one-stop-solution-for-smbs-to-manage

Get Course: What is Managerial Computing