Electric Vehicle, Real Estate, and Start-ups are hopeful that there are micro details in Budget 2020 that might help these sectors or industries

The Union Budget 2020-21 introduced by Hon’ble Finance Minister Niramala Sitharaman is very much appreciable on the note that a new optional income tax system is proposed for individual tax payers. “Now individual tax payers who are not willing to claim deductions under various provisions of the Income Tax Act are now provided with an option to pay tax at reduced tax rates which enables a tax payer to avail a beneficial option out of two “VIVAD SE VISHWAS SCHEME” will help to resolve long pending tax disputes. Waiver of interest and penalties would attract a lot of tax payers to opt for the scheme said CA Inderpal Singh Pasricha, Senior Partner, I. P. Pasricha & Co.

-

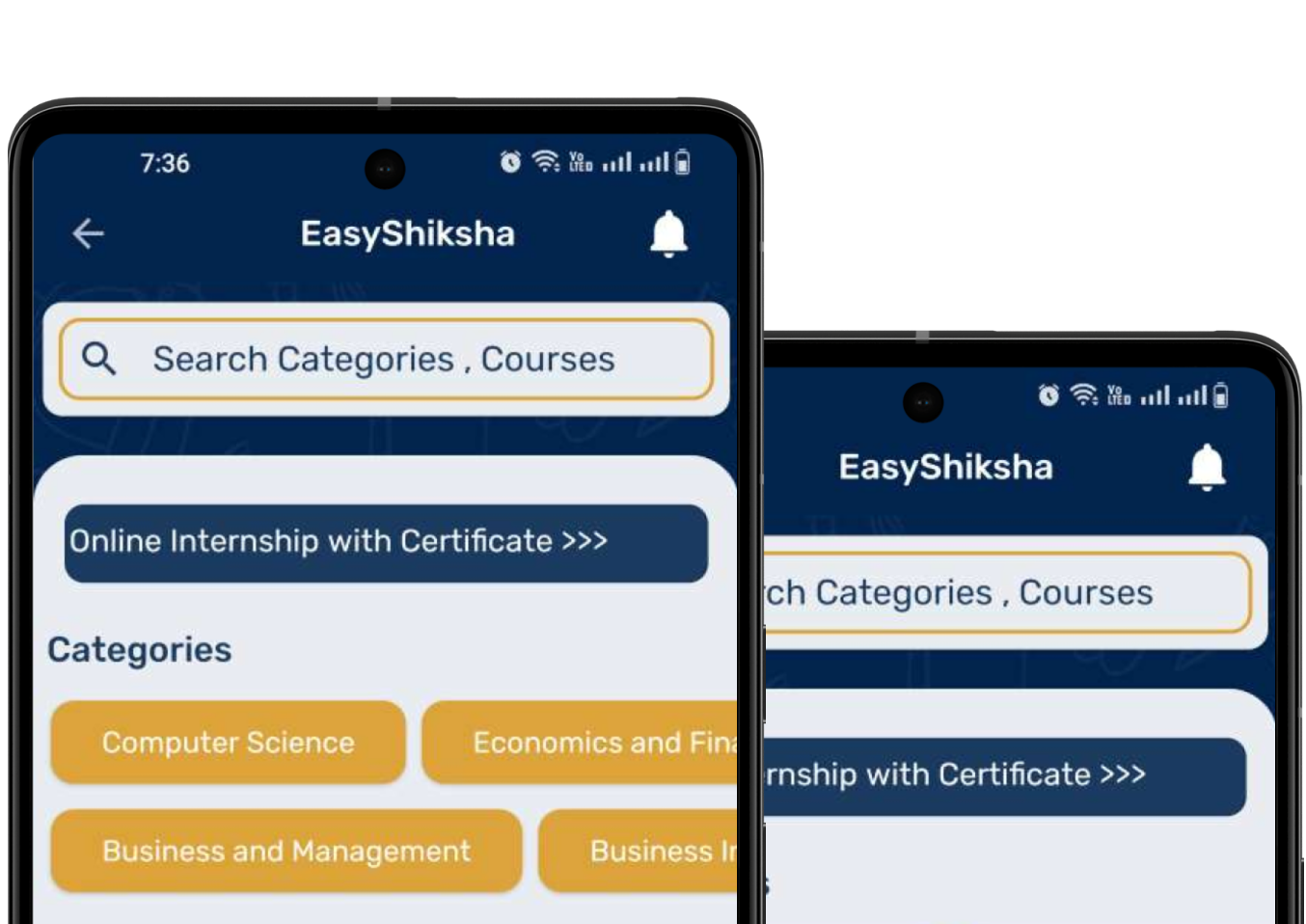

Online Internship with Certification

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

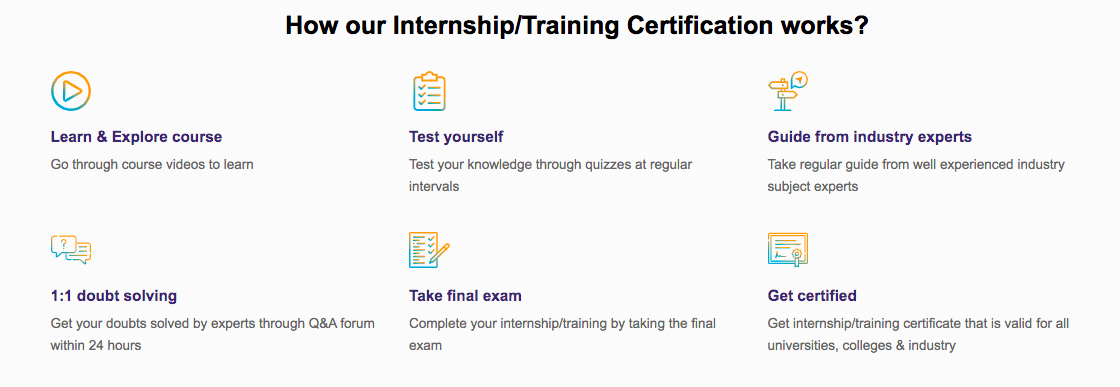

How EasyShiksha Internship/Training Program Works

Top Courses in Computer Science Engineering Top Courses in Virtual Reality

Loading...

The impetus of government on the development of technology and making country Digital will go a long way in encouraging startups like us working in the domain. Also the government has allocated a fund of Rs 96000 crore on education will mean more students coming in and with them the responsibility of companies that are working in that domain such as the ones working on financing the students during the time of their education. The Budget is forward looking as its focus is the overall development of economy, which calls for a concerted effort from every sector to make India a USD 5 trillion economy said Mr. Jaijash Tatia, Co-founder, StuCred.

-

Top Courses in Computer Science Engineering Top Courses in Software Engineering

Loading...More Courses With Certification

Real estate sector was hoping to get some announcements that could provide the much-needed boost to the sector. However, the Budget had very little to offer to the sector directly. Budget has touched upon the aspects that are going to boost the GDP including infrastructure spend, rural economy, income tax relief, Rs 4,400 crore allocated for cities to ensure clean air, and tax holiday on loan sanction for affordable housing. Commenting on the real estate Kshitij Nagpal, President, Association of Property Professionals, said, “Thrust on infrastructural development will have a direct bearing on the demand of real estate projects. Announcement like income tax relief, and ease in tax for Real Estate Transactions from 5% limit presently to 10% will make the fence sitters show interest in buying property. Real estate will definitely get benefit with the increasing demand. However, it would have been good if the FM had addressed the concerns of the developers related to land prices, raw material cost and time taken in getting permissions.”

India is the third biggest startup ecosystem in the world and the focus of the government has been was to provide a push to the innovative startups through policy interventions. Start-ups showed were positive about the announcements made in the Budget. Sparsh Khandelwal, founder, Stylework, a start-up operating in co-working aggregation domain, said, “From the Budget it is clear that the budding entrepreneurs will have ease of doing business as the FM announced that tax harassment will be stopped. Corporate tax reduction will also help the start-ups to prosper. Today’s Budget also has some announcements such as a five-year tax holiday on Esops, a 10-year tax exemption for startups with under Rs 100 crore turnover, a total of Rs 27,300 crore allocated to industry and commerce will also give a boost to the start-up story in India, and also talks of a seed fund to push new businesses.”

Another upcoming segment in Indian economy is the Electric Vehicle and it was waiting for positive announcements that could have helped in the growth of this sunrise sector. Sqn Ldr Prerana Chaturvedi, CEO and ED, Evolet, said, “We have been waiting for good but we haven’t heard anything significant. We have been patient and we will continue to be patient. Now we all agree that it is green and sunrise industry and if we have to pay respect to the sunrise industry then we have to stand with the industry. If we expect a start up to create a disruption then we have to support that sunrise industry.”

“Though there are no direct announcements for the electric vehicle segment, we can see ray of hope in announcements such as allocation of Rs 4,400 crore for cities to ensure clean air and relief in income tax. People will now have more disposable income at hand and this might trigger the demand for electric vehicles. However, the government should have abolished the custom duty of 5 percent on lithium-ion battery cells that could have made the EVs more affordable. The cost of batteries are high and we were expecting the Government will provide incentives for the sourcing of raw materials for EV battery manufacturing in India that would have helped in creating an EV-centric ecosystem,” she adds.

Top Courses in Networking

More Courses With Certification

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowALSO Read: Himesh-reshammiya-2-0

Get Course: Computer-Networking-for-Beginners