The banking sector has become a go-to option for job seekers due to the financial stability, competitive pay, and job security it promises. Year on year, Independent recruiting bodies responsible organize and conduct exams/selection processes to hire qualified Bank PO banking personnel for mid level and senior level posts across functions, departments and offices.

With lots of opportunities, aspirants are often left confused about which role and exam to go after. The biggest dilemma is whether to target the bank PO or the bank clerk exams.

In this article, we will not only go over the two roles, the associated responsibilities and growth opportunities in detail but also list out the differences to help you to make an informed decision.

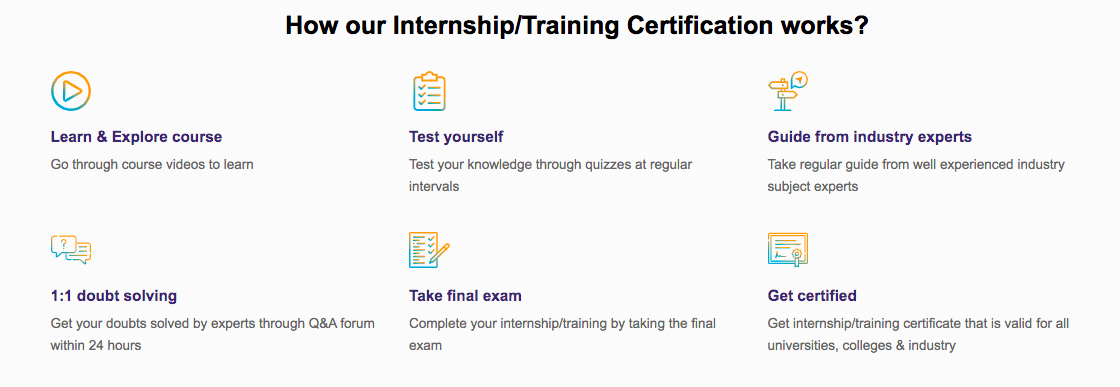

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

#1 Salary & Designation:

The salary is probably what you are most eager to know. The bank clerk is obviously a clerical cadre role while the Bank Probationary officer’s (PO) role is a managerial one. A bank PO often supervises clerical tasks. The salary of a bank PO can be anywhere between INR 40,000 and INR 43,000 per month while the salary for a bank clerk ranges from INR 20,000 to INR 25,000. The salary can vary based on the employer and the state/region where you are employed.

While we understand that the pay package plays a significant role in the decision making process please don’t base your decision purely based on the salary alone.

#2 Pathways and Eligibility Criteria:

The IBPS (Indian Banking Personnel Selection) and SBI (State Bank of India) exams are the most preferred gateways to both the roles. For the clerical cadre, you can take either the SBI clerk or the IBPS PO. If you are aspiring to become a PO then the IBPS PO and SBI PO exams would be the way to go.

The eligibility criteria for all 4 exams are almost identical with subtle differences in the age limit. For example, the basic IBPS Clerk eligibility criteria is a graduate degree from any recognized University or college. This basic criteria also holds good for the IBPS PO, SBI PO, and SBI clerk selection processes. Some of the private banks such as the Bank of Baroda (BOB), and ICICI conduct their own selection processes to find qualified candidates for the PO role and clerical cadre.

#3 Difficulty Level & Competition

Traditionally, the SBI exams are known to be more difficult compared to the IBPS exams even though the syllabus and exam pattern are very similar. The IBPS Clerk syllabus is almost identical to that of the SBI clerk.

Over 10 banks including the Bank of Baroda (BOB), Canara bank, Indian Overseas Bank (IOB), Punjab National Bank (PNB), Bank of India (BOI) and Central Bank of India take part in the IBPS Clerk and IBPS PO selection process. Since multiple banks recruit through the IBPS, more vacancies can be expected in the IBPS exams as compared to their SBI counterparts. Irrespective of the number of vacancies, lakhs of aspirants like you apply for both the clerk exams and the PO exams

Top Software Engineering Courses

#4 Career Growth:

If you kick-start your career in the banking sector as a Probationary Officer then you start slightly up the hierarchical order as compared to the clerical cadre in which the candidates who clear either the SBI clerk or IBPS clerk start their careers.

Timely promotions can be expected by both Bank POs and Bank clerks. There are two ways of climbing up the ranks. You can either be promoted once in two or three years based on performance or you can ace internal department specific exams to get promoted. If a bank clerk pursues a relevant post-graduation degree then he/she may also be promoted. The remuneration increases significantly as your designation changes. A bank PO can become an Assistant Manager within 2 years. Candidates who start out as clerks in a bank take slightly longer to move up the ladder but if you stick to it then you can even become a chief manager or an Executive Director (ED).

#5 Responsibilities

A bank clerk typically monitors the work of the sub-staff & other clerks, maintains records & ledgers, handles cash withdrawals & deposits for customers and issues receipts, cheque books etc. Marketing the products and services of the bank is also a part of the job description. Clerks are typically the first point of contact for customers.

Bank POs are responsible for bringing in new customers, expanding the product portfolio, supervising loans, and handling customers’ issues. The bank POs are also responsible for supervising the clerks. A bank PO will gain practical knowledge of finance, accounting, marketing, loans etc on the job.

Now that you know everything there is to know about the bank clerk and PO jobs, apply for the ideal role and start preparing!

For information related to technology, visit HawksCode and EasyShiksha

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowALSO READ: iiit-naya-raipur-establishes-center-applied-mathematics-promote

Get Course: English-Grammar