- Only 18% of Indian investors, far less than the 50% of global investors, prioritize retirement as an investment goal

- 93% of Indian investors eligible for a state-sponsored financial benefit in old age trust it will pay out benefits as promise vs 62% of investors globally.

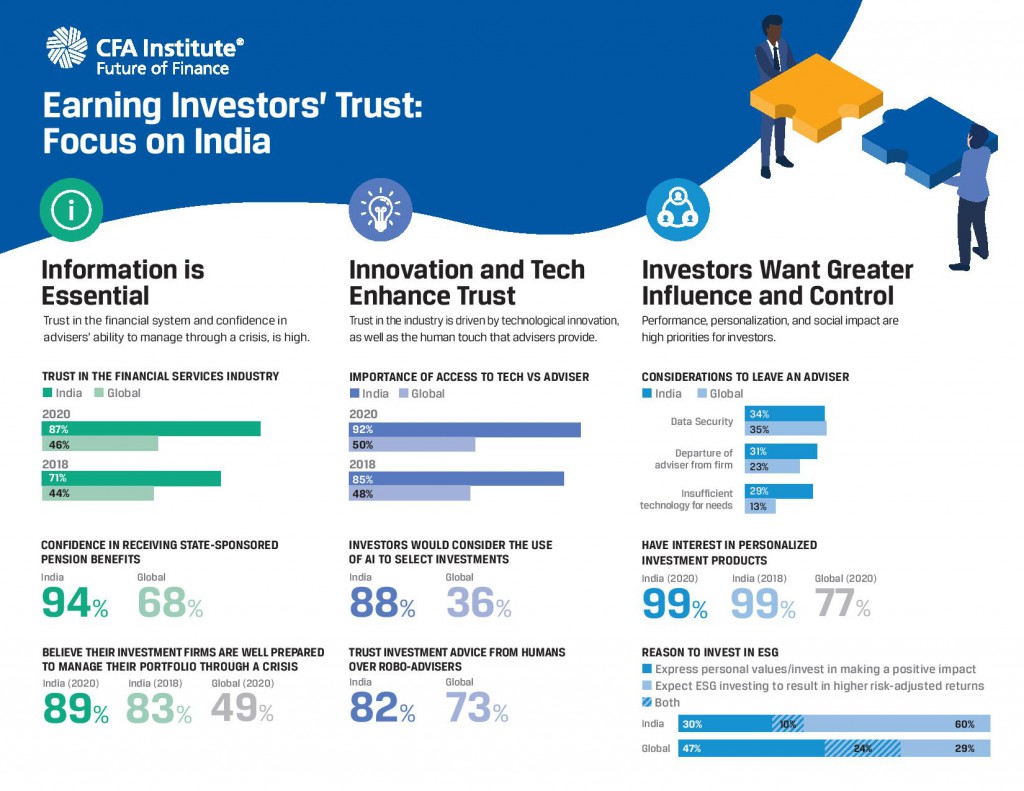

Mumbai, 25 June 2020: CFA Institute, the global association of investment management professionals, released the fourth edition of its trust report, revealing that 87% of Indian investors trust the Indian financial markets, up from 71% in India in 2018. Retirement By comparison, 47% of investors globally and 49% of investors in Asia Pacific trust the financial services industry.

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

The report, “Earning Investors’ Trust: How the Desire for Information, Innovation, and Influence is Shaping Client Relationships” studied both retail and institutional investors in 15 markets globally, measuring their trust level in the investment industry. The report also reveals that retirement is the priority investment goal for only 18% of Indian investors, far less than the 50% of global investors.

Speaking on the survey, Vidhu Shekhar, CFA, CIPM, Country Head, India, CFA Institute said “The Indian Equity Markets have delivered good returns over the long run and this helps explain optimism and trust in the system, as well as investor confidence. These are challenging times and trust plays a very important role in the world of finance. The responsibility for ensuring that our industry works in the interest of the ultimate benefit of investors rests on all of us who are part of this profession”.

“Ecosystem participants, including security regulators, are putting significant effort into increasing financial literacy, transparency, and fair market practices that can provide a foundation for increased trust. This has resulted in improved outcomes for everyone, but there is still a lot that needs to be done in these areas”, he added.

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se” during this lockdown.

Top Software Engineering Courses

The survey found 87% percent of retail investors in India said they trust the financial services industry, which puts the country at the top of the list of the 15 surveyed markets, whilst Australia ranked last, with only 24% respondents saying that they trust the industry. When comparing the trust levels between 2018 and 2020, India (87% vs 71% in 2018), Hong Kong SAR, the UAE, and Brazil have recorded the biggest rises, whereas Singapore and Australia are among those that reported the biggest drops.

Trust level in the financial industry among retail investors in the APAC region:

| Market | 2020 | 2018 | +/- % |

| India | 87% | 71% | +16% |

| China | 69% | 70% | – 1 % |

| Hong Kong | 52% | 35% | +17% |

| Singapore | 36% | 47% | -11% |

| Japan | 27% | N/A | N/A |

| Australia | 24% | 31% | -7% |

The survey also reveals that approximately two-thirds of institutional investors and nearly half of retail investors with an adviser trust their investment firm more because of the increased use of technology. When asked to choose between access to technology or a human, the trend has been for more technology, and for the first time, retail investors globally have an equal preference for technology and people. Notably though, 82% of Indian investors said they still trust investment advice from humans over robo-advisers.

Key Survey Findings For India:

- Retirement planning not a priority for Indian investors

- Retirement is the priority investment goal for only 18% of Indian investors far less than the 50% of global investors. 22% are focused on saving for Emergency Funds. 59% think it is very likely that they will achieve their investment goals but 94% trust that their investments will provide enough wealth that they will not need to work past their desired retirement age.

- 93% of Indian investors eligible for a state-sponsored financial benefit in old age trust it will pay out benefits as promised vs 62% of investors globally.

- Trust in the financial system and confidence in advisers’ ability to manage through a crisis, is high

- In 2020, 87% of investors in India trust the financial services industry and less than the 47% of investors globally. In 2018, 71% of Indian investors said they trust the financial services industry, and 44% globally.

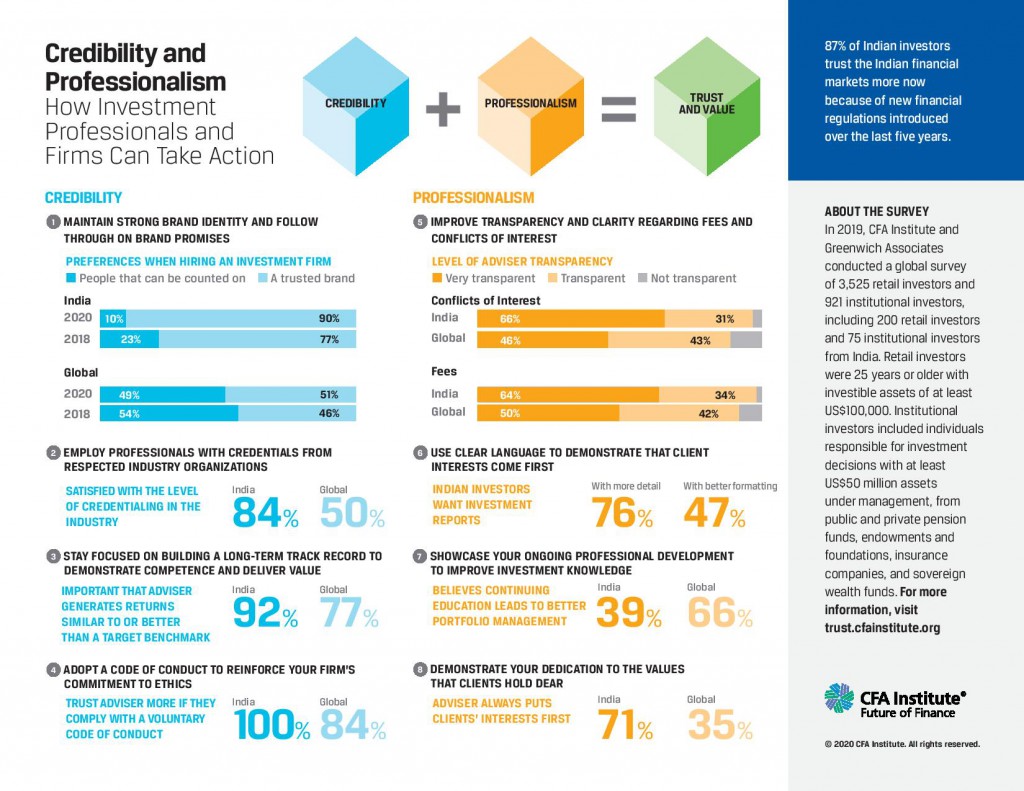

- Indian investors are much more satisfied as global investors are with their financial advisers and their performance around factors that help build trust with clients. For example, 84% of Indian investors are satisfied with the way their FAs fully disclosure fees and other costs as opposed to 48% of global investors.

- 97% of Indian investors agree with the statement I have a fair opportunity to profit by investing in capital markets, as compared to 72% of investors globally.

- A notable 81% of Indian investors are very confident about their ability to make investment decisions vs 28% of investors globally.

- 87% of investors trust the Indian markets more today than 5 years ago. The following are the top things that would cause Indian investors to invest more: 60% having more education about how to invest, 58% having access to more types of investment internationally, and 52% having access to more types of investments in India.

- Performance, personalization, and social impact are high priorities for investors

- For Indian investors, the top-ranked attributes when hiring a financial adviser includes Trusted to act in my best interest – 27%, Ability to achieve high returns – 18% and Recommended by Someone I Trust – 15%.

- When thinking of hiring a firm 90% of Indian investors prefer a: A brand I can trust over People I can count on as compared to 51% of investors globally.

- When considering leaving a firm or professional the greatest factors for Indian investors are Data Security (India 34% v 35% Global), Departure of Adviser from Firm (India 31% v 23% Global) Has publicly stated views on social or political issues that I disagree with (India 29% v 15% Global) and then Insufficient technology to meet my needs (India 29% v 13% Global).

- 71% of Indian investors think their adviser “Always” puts their interests first as compared to 35% of investors globally.

- When it comes to ESG investing the priority 91% of Indian investors (compared to 70% globally) is for increased returns over decreased risks. 91% said they would give up some return for values-based objectives (compared to 67% of investors globally). 30% of Indian investors are interested in ESG to express personal values or to make a positive impact on society, 60% are looking for higher returns, and 10% expect both.

- 78% of Indian investors would lose trust in their adviser after one year of poor performance as compared to 40% of investors globally.

- Trust in the industry is driven by technological innovation, as well as the human touch that advisers provide

- When asked about the Perceived Importance of Access to Adviser vs. Technology over the Next Three Years, 92% of Indian investors preferred tech over people to help manage their investments compared to 50% of investors globally.

- 82% of Indian investors trust investment advice from humans over robo-advisers.

- 88% of Indian investors would be willing to invest a fund that uses Artificial Intelligence for its selection process as compared to 36% of investors globally.

- 90% of Indian investors say they trust their investment firms more because of their increased use of technology as compared to 48% of investors globally.

- 98% of Indian investors say that it is important for their advisers to give them access to new investment products before they become widely available as compared to 64% of investors globally.

- Another Financial Crisis?

- 78% of Indian investors think it is very likely that there will be another financial crisis in the next three years compared to 49% of investors globally. 40% believe the likely cause would be national politics, followed by 30% global politics and another 30% think it will come about by governments defaulting on debt. However, 89% believe that their investment management firms are well prepared to manage their portfolio through the crisis as compared to 49% of investors globally.

Retirement The Trust Survey was conducted with 3,525 retail investors and 921 institutional investors in October and November 2019. The surveyed markets included Australia, Brazil, Canada, Mainland China, France, Germany, India, Japan, Mexico, Singapore, South Africa, UAE, UK, US, and Hong Kong SAR, China. Retail investors were aged 25 years or older with investible assets of at least US$100,000, except in India where the minimum was adjusted to INR500,000. Institutional investors included individuals responsible for investment decisions with at least US$50 million assets under management, from public and private pension funds, endowments and foundations, insurance companies and sovereign wealth funds.

Empower your team. Lead the industry

Get a subscription to a library of online courses and digital learning tools for your organization with EasyShiksha

Request NowTo review the complete report and survey results, including market-by-market data, visit trust.cfainstitute.org

About CFA Institute

Retirement CFA Institute is the global association of investment professionals that sets the standard for professional excellence and credentials. The organization is a champion of ethical behavior in investment markets and a respected source of knowledge in the global financial community. Our aim is to create an environment where investors’ interests come first, markets function at their best, and economies grow. There are more than 170,000 CFA charterholders worldwide in 162 markets. CFA Institute has nine offices worldwide and there are 158 local member societies.

For more information related to technology, visit HawksCode and EasyShiksha

ALSO READ: fincare-small-financebank-max-bupa-partner-offer-comprehensive

Get Course: Web-Designing–HTML-CSS-and-Twitter-Bootstrap