This appointment helps strengthen LenDenClub’s key leadership team ahead of the next planned growth phase

Delhi, May 19, 2022: LenDenClub, India’s largest Peer-to-Peer Lending platform, with its vision to drive financial inclusion, is building a formidable leadership team as it prepares for its next growth phase, chasing an ambitious goal of $1 billion in loan disbursals. To this effect, the RBI registered NBFC-P2P has made a key leadership appointment and hired CA Mudit Agarwal as its first Chief Business Officer – New Business Initiatives. Mudit joins LenDenClub with over two decades of experience in the Banking and Financial Services Industry (BFSI), managing risk and returns strategies, P&L ownership, Cost Optimisation Projects, solving Portfolio Management Challenges, and New Product Development.

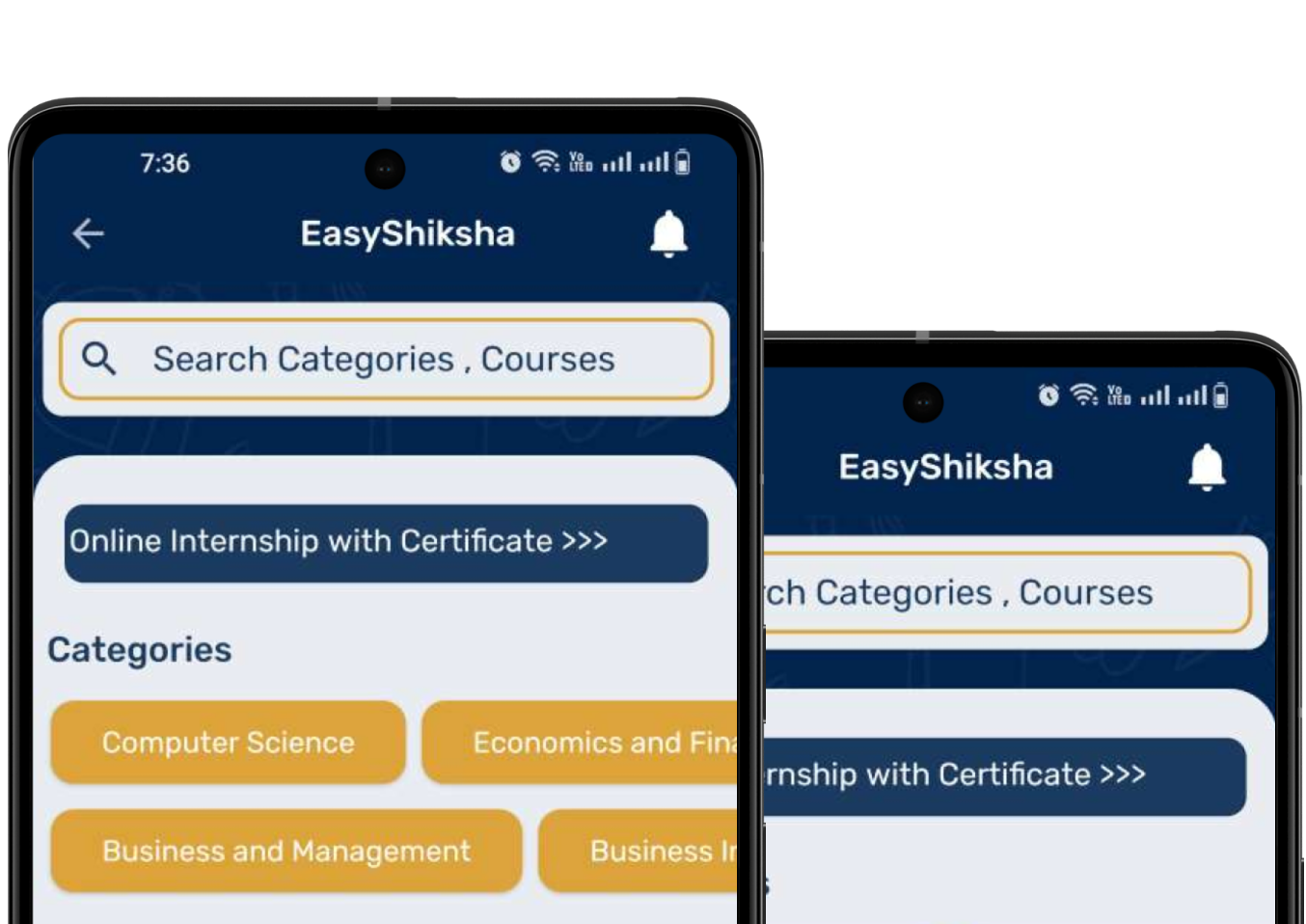

Important Announcement – EasyShiksha has now started Online Internship Program “Ab India Sikhega Ghar Se”

At LenDenClub, Mudit will be responsible for identification, development and execution of new business segments within existing business lines to drive efficiencies. He will also explore new business opportunities to build the Alternate Investment Portfolio for investors with a combination of fixed and variable income product alternatives which aim to provide flexibility and liquidity.

visit easyshiksha for skill development

With an illustrious career spanning over two decades, Mudit brings a comprehensive experience from the finance ecosystem, where he excelled with New-Age Private Banks, various NBFCs and Fintechs from India and across the globe. He has spent his last seven years in leadership positions with prominent brands such as Capital Float, Tata Capital, and Kobo360, driving profitability with his contribution. In addition, he has managed various functions in the lending space, both on the Business and the Credit Risk side. His core functional competencies include Credit & Risk Control, Receivables Management, EWS, Credit Policy, Appraisal & Underwriting, Finalising Control Measures, and Process Re-engineering in the Banking, Financial and Logistics sectors. In his last stint with Kobo360, which is an Uber for trucks in Africa, he was heading their finance vertical.

READ: delta electronics india

Speaking on the appointment, Bhavin Patel, Co-founder & CEO, LenDenClub, said, “This financial year, we aspire to achieve exponential growth. $1 Billion in Loan disbursals is what we are targeting, and my firm belief is that we need a strong leadership team to achieve this and set up a base for the next 10X growth. I am delighted to have Mudit on our leadership team. He has demonstrated a strong track record of scaling fast-growing companies to become industry leaders. He shares a deep passion for our mission, and I feel that he is the right fit to make an impact in aiding LenDenClub’s growth trajectory and achieving immediate and future growth targets. I wish Mudit all the very best in his endeavour to establish new lines of business and a long, fruitful and mutually beneficial stint with us.”

LenDenClub is a uniquely well-positioned organisation that seeks to meet needs that other financial institutions have failed to provide.

Speaking on his appointment, Mudit Agarwal said, “LenDenClub is a profitable and well-positioned organisation, which strives to fulfil the demands that have been left unmet by other financial companies. It has a strong business model, and I look forward to using my expertise to accelerate growth by expanding its current business lines and increasing profitability. The company is focused on growing aggressively, and I am keen to fuel LenDenClub and its ambitious growth plans. Ultimately, I want to contribute towards digital India by using my experience in building a sustainable alternate investment and finance option for the people of India.”

LenDenClub’s operational success has been stellar in FY 21-22, with record disbursements, customer acquisitions, top-line growth, profitability, and differentiated product offerings. In addition, the company has crafted a multi-pronged strategy to accelerate its growth by becoming the preferred Peer-to-Peer lending platform for the country’s underserved investors and borrowers and assisting them with their diverse financial needs. This appointment is in addition to other critical strategic appointments made by LenDenClub in the recent past where it appointed Atal Agarwal as its Head of Initiatives and New Strategy in March ‘22. The company has a very well thought-out and astute people strategy; it believes in having a strong leadership team which will be essential in driving the company’s growth objectives.

The company recently raised $10 million in a Series A round co-led by a consortium of investors, including Tuscan Ventures, Ohm Stock Brokers, and Artha Venture Fund.

About LenDenClub:

LenDenClub is a leading Peer-to-Peer Lending platform that provides an alternate investment opportunity to investors or lenders looking for high returns with creditworthy borrowers looking for short term personal loans. With 1 million+ investors on board, LenDenClub has become a go-to platform to earn returns in the range of 10%-12%. LenDenClub offers investors a convenient medium to browse thousands of borrower profiles to achieve better returns than traditional asset classes. Moreover, LenDenClub is safeguarded by market volatility and inflation. LenDenClub provides a great way to diversify your investment portfolio.

Additionally, with more than 2.5 million+ borrowers, InstaMoney, its borrowing platform has disbursed over Rs. 2,000 crores of loans to date. It offers instant personal loans to salaried individuals with flexible loan tenure. The platform aims to foster financial inclusion by leveraging technology to support borrowers with hassle-free loans, even in the remotest parts of the country. InstaMoney also provides small merchant loans of up to Rs. 1,50,000 to borrowers who are into SME business. Through InstaMoney’s partnership with merchants, Instamoney also extends the popular service of Buy Now Pay Later to the end consumers or shoppers.